A Space Intelligence Play at 2.8x Sales With 214% Revenue Growth

Programming note: we’ve been a little quiet lately as we work on some big things for 2025. Going forward, we’ll be focusing our efforts on actionable investing ideas in the small and mid cap space with a greater emphasis on quality over quantity. We have some big ideas lined up and hope you enjoy this deep dive into BlackSky Technology (BKSY stock).

About The Business

BlackSky Technology (BKSY) was founded in 2014, through a SPAC merger of Osprey Technologies and BlackSky Holdings. After the merger BlackSky became a public company and received $283M. $103M was from the money Osprey raised and $180M from a PIPE deal.

BlackSky operates a constellation of small, low-earth orbiting (LEO) satellites, which are used for frequent image collection. These are utilized for geospatial intelligence, earth surface monitoring and reconnaissance. BlackSky’s satellite constellation provides real-time imagery services for economic monitoring, national security, disaster management, supply chain intelligence, critical infrastructure monitoring and high frequency monitoring of critical locations/objects, which are delivered in an easy-to-access, user friendly manner using their Spectra software. Their system is fully automated and can be used to provide time-sensitive insight. The company currently has 280 employees. BlackSky's edge lies in its rapid monitoring capability, with satellites able to capture imagery of the same location up to 15 times per day - a frequency set to increase further with their next-generation (Gen-3) satellites.

BlackSky enhances its satellite data with external sources like Synthetic Aperture Radar (SAR) for detailed earth imaging regardless of weather or lighting conditions, radio frequency (RF) data used to track communications, and information from GPS-enabled and IoT devices. This comprehensive data collection — spanning satellite imaging, SAR, RF, GPS, asset tracking, internet-enabled sources, environmental sensors, and IoT devices — is processed using AI and ML techniques through their Spectra software platform. Clients can access Spectra via web and mobile interfaces, receiving imagery and analytics typically within 90 minutes. The platform also supports API integration for seamless integration with customers' IT frameworks.

BlackSky’s offerings include images and data analytics, both provided through Spectra (software platform), which is usually sold through a subscription model. Additionally, they sell professional services (customizing software according to customer’s needs) and engineering services (selling satellites and payload systems instruments like cameras, radars etc.). These services are offered on a project-to-project basis. Booking sales of satellites before production and utilizing a subscription model allows the company to maintain a stable revenue base. Clients leverage BlackSky’s knowledge by using their engineering services, which includes designing satellites, managing ground operations and creating software systems. The company also provides special services which can be customized according to the business’ needs. For example, clients can pay a premium to prioritize their monitoring needs during critical situations.

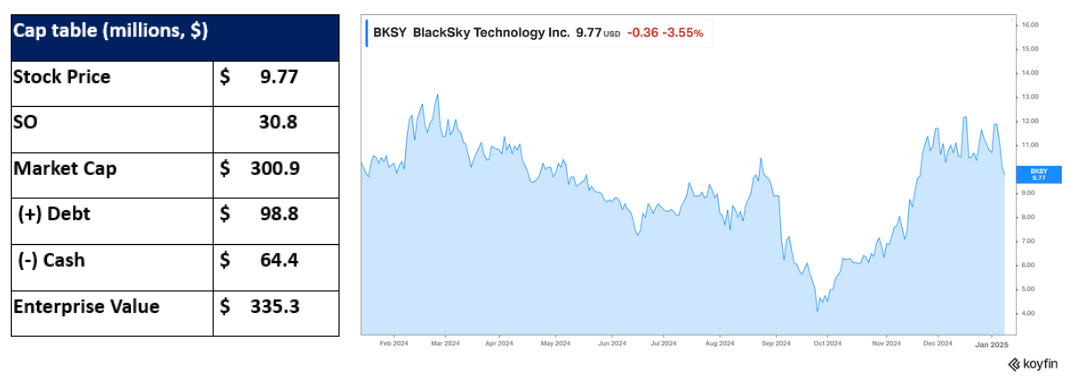

The company have issued Class A common stock (BKSY) and warrants for class A shares with the exercise price of $92 per share (BKSY.W). Both trading on NYSE.

Long Thesis

Although not without risk we think BKSY stock represents an asymmetric opportunity based on the following factors:

Operating leverage. BlackSky’s satellites are intended to provide high-margin data and analytics. Once its satellites are set in place, the company doesn’t need to spend much to generate profit. This is evidenced by the income statement where BlackSky revenues have increased 214% since 2021 while operating expenses have gone up by only 11%. Once scale is reached, BlackSky should be able to produce high margin, recurring cash flows.

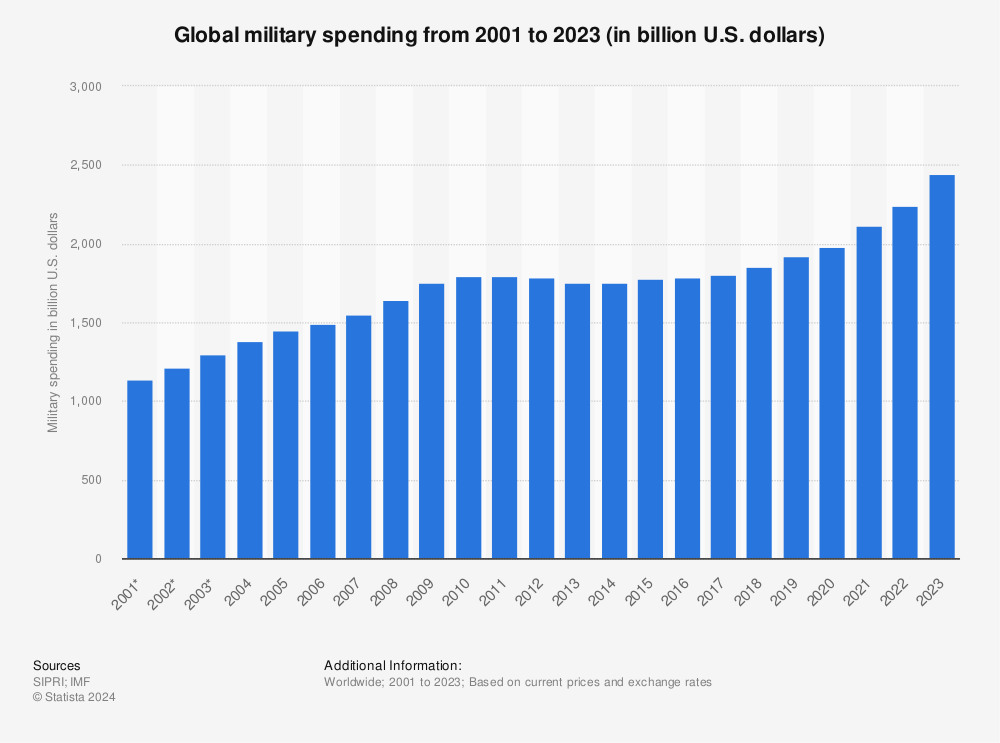

Secular tailwinds in space and defense spending. Investment in space presents a long-term secular tailwind while defense spending is rising globally in the wake of the Ukraine war. 2024 saw the largest annual rise in government spending on defense in over a decade (see chart further down).

Government contract wins. BlackSky has demonstrated product efficacy following a slew of recent contract wins from the US government. We are still in the early innings of this company - success in the commercial world would increase the company’s total addressable market and expand the valuation dramatically.

Gen-3 satellite launch. While not without risk, the launch of BlackSky Gen-3 satellites should improve the company’s competitive position and lead to increased revenues. This is because Gen-3 satellites will offer better resolution and an increased revisit rate. This potential catalyst (set for early 2025) can also ignite interest from retail investors which can contribute to positive sentiment around the stock. We have already seen several space-related stocks soar over the past 12 months such as ASTS.

Reasonable valuation. With a market cap just over $300 million, BlackSky is valued at 2.8x sales which is attractive versus peers like Planet Labs (4.6x sales), Redwire (3.5x sales), Globalstar (14.8x sales), ASTS (>2000x sales) etc. Qualitatively, a $300 million valuation seems reasonable given the company’s product offering, revenue growth and contract wins.

Possible acquisition target. As the industry develops and consolidates, BlackSky could be seen as a potential acquisition target for a larger player like Maxar. Long-term, there is likely to be a limit to how many satellites will be allowed in orbit, therefore, companies entering orbit now can secure a first-mover advantage.

The biggest risk to BlackSky is liquidity. The company is not yet cash flow positive and may need to raise additional funds. A major setback like launch failure may even be fatal for the company. However, we think immediate downside risk is balanced by the potential for significant long-term upside.

Industry Overview

We are seeing an increase in geopolitical tensions and heightened spending on surveillance for national security (see chart). Alongside this, the need for monitoring of critical areas and environmental monitoring will also benefit BlackSky. There is a requirement for dynamic, on-demand high frequency imaging solutions, rather than static low-frequency satellite images. BlackSky also has the ability to provide geospatial intelligence/space domain awareness (SDA), to track and monitor space objects in order to avoid collisions, rather than just earth monitoring. However, this market is competitive. Other companies in the aerospace and defense industry include Rocket Lab, Planet Labs, Maxar, Satellogic, Airbus defense, Boeing defense, Spire global, Intuitive machines etc.

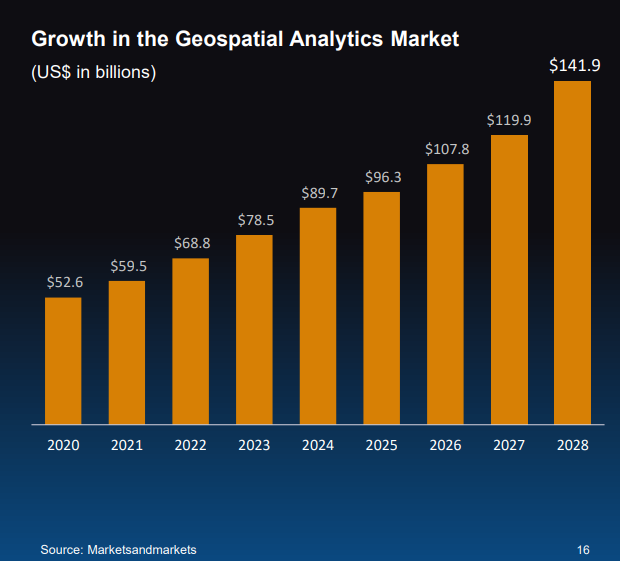

The market is also growing. According to Markets and Markets, an independent research firm, the global geospatial analytics market is projected to grow from about $79 billion in 2023 to about $142 billion by 2028, resulting in a compound annual growth rate of 12.6%. It’s a huge market and there is space for more than one player. That said, the industry is still in flux. Mergers, acquisitions and failures are to be expected going forward.

In this industry companies are often dependent on government contracts. Paradoxically, past companies in the defense and space industry have faced challenges due to an overreliance on government contracts. Such reliance can lead to expansion that is too rapid and a failure to diversify leaving them exposed to policy changes. The market being highly competitive means that any setback in satellite deployment failure will be punished and can potentially give competitors an edge. However, BlackSky has competitive advantages within its niche and its competitors also have different focus areas. This doesn’t mean all companies will survive and thrive. The differences between companies in this industry are slight, but they matter because of how specialized and specific customer needs are.

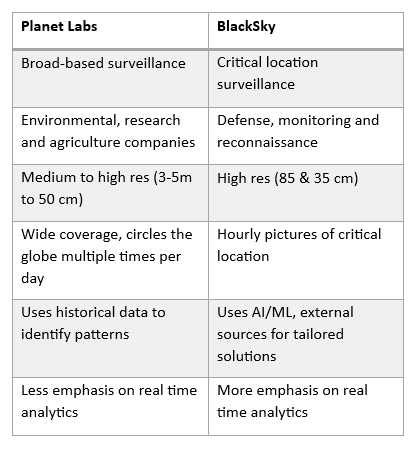

For example, Planet Labs and BlackSky both use constellations of small satellites but they have subtle differences as seen in the table below:

There are also ethical issues around the technology being used in monitoring and surveillance (mostly privacy concerns). BlackSky needs to manage these issues if they want to scale and take advantage of economies of scale without facing backlash from the public and regulators.

Competitive Advantages & Risks

Companies need to have product differentiation and competitive advantages to thrive in this space. According to management this comes from offering solutions at a more affordable rate, with a scalable platform because of their SaaS and capital efficient satellite structure. The reason for their cheaper satellite constellation is due to them covering locations where approximately 90% of world’s GDP occurs (instead of the whole globe) which allows them to cut costs.

Unlike traditional satellite companies that operate satellites from pole-to-pole, BlackSky fly mid-inclination orbit over critical locations for dynamic monitoring. These satellites have a high revisit rate of a location of 15 times per day (number of times the satellite constellation can capture images of a location). This is with the current Gen-2 satellites for their monitoring missions. They are expected to launch the Gen-3 satellites in early 2025.

BlackSky’s satellites operate in low earth orbit (LEO) – 450 Kms from the earth. Each satellite has an optical telescope with resolution of 85 cm (which means 85 cm on the ground = 1 pixel, which can help discern buildings, vehicles, people, large road markings and patterns). These satellites are used to monitor troops, vehicles, progression on construction sites, ships in ports and important locations. BlackSky’s new Gen 3 satellites can take pictures at 35 cm resolution, with a 30-minute revisit rate. It also has 1-meter SWIR (short waved infrared) technology to counteract heavy smoke, haze, fog and clouds. This helps taking images in low light conditions. Also, Gen-3 allows faster data transmission to the end user, helping in industries like defense, agriculture, urban planning and environmental monitoring. Note - LEO (low earth orbiting) satellites are between 180-2000 kms from earth surface and they move at speeds as high as 27,500 km/h to counteract earth’s gravitational pull.

Leo-Stella, a 50%-owned JV with Thales Alenia Space manufactures satellites for BlackSky and has capacity of up to 40 per year. BlackSky controls the operation process. In Q3 2024 they acquired the full company Leo-Stella.

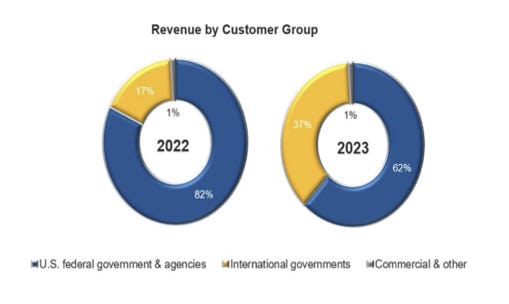

Currently, the company’s customer base is tilted towards US defense and intelligence. Diversification is important in this industry, as some of the previous companies that have failed were unable to diversify revenues. Being at the mercy of a budget cut from the US government in reconnaissance or surveillance spending is dangerous for the company. That said, surveillance spending seems an unlikely area to be cut given the current geopolitical climate.

Management divides the customer base into 3 categories:

US federal government & other US agencies – They have contracts with multiple US defense, intelligence and other agencies (government and civilian). Two examples - National reconnaissance office (NRO) and National Geospatial-Intelligence agency (NGA), They also have Department of Defense customers like air force.

International governments and other organizations – These contracts are worth more than $250M. Some of them are undisclosed. They are multi-year multi-million contracts on subscription basis mostly.

Commercial contracts – Only 1% of revs but the images and analytics could be used by logistics, supply chain management, agriculture, environmental monitoring, disaster management, investment firms and many other organizations.

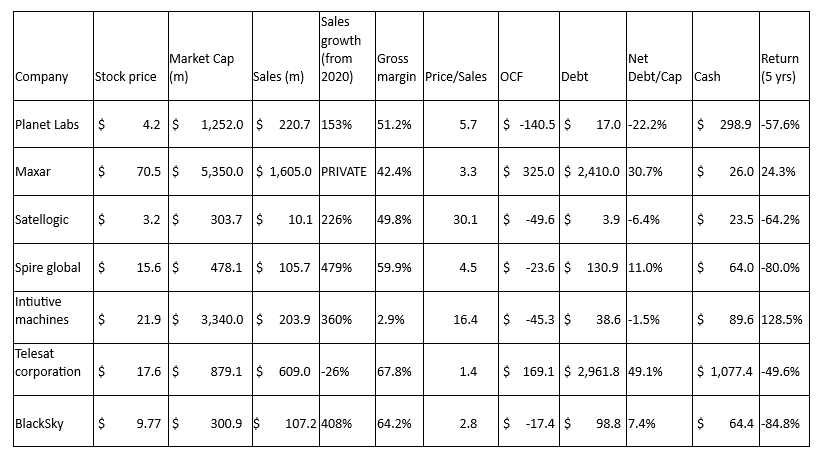

Competitors

Planet labs - Earth imaging company with the world's largest fleet of satellites. Their satellites are used for daily earth coverage and capturing images over large areas (with 3-5 meters res) for earth observation rather than high revisit on-demand imagery and analytics.

Maxar - They are an integrated company, with a focus on using imagery for detailed mapping, 3D models and space exploration. Also partnering with NASA to help them in space exploration. Their fleet can capture 30 cm resolution images. BlackSky is focused on real-time high frequency monitoring to give intelligence using AI and ML (faster insights using more data). Maxar went private in 2023 at a reported $6.4 billion valuation.

Satellogic - They operate small high-res imaging satellites (0.7m). Their data is used for agriculture, forestry, energy infrastructure, urban panning etc. In 2024, they entered a partnership with Maxar, allowing them to get near real-time monitoring data for the US government and other international partners.

Spire global - Uses nanosatellites in LEO to collect atmospheric, maritime and aviation data. Focused on collecting tracking and atmospheric data rather than real-time imagery and geospatial intelligence.

Intuitive machines - Services to help Space and moon exploration.

Telesat global - Satellite communication system, geospatial intelligence, data solutions and consulting services.

Capella Space and ICEYE are also in the small SAR satellite monitoring industry, but both are private. Capella has around $100M in revenues and in 2024 they received $400M+ funding.

Business Model

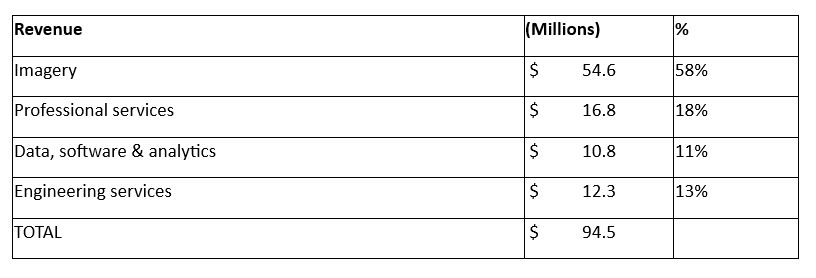

BlackSky offers different pricing options like subscriptions, usage-based pricing and transactional licenses. Their revenue streams are divided into imagery; data, software and analytics; and professional and engineering services.

Imagery – This is the satellite imaging which is taken by the satellite constellation of the company. Various options include basic plans for short term projects or ad-hoc needs or multi-year contracts with the option to pay premiums for priority information and minimum level of payment.

Data, software and analytics – This is provided on a subscription basis. It includes insights about critical locations and monitoring changes at these locations. Company uses AI/ML to provide these insights.

Professional and Engineering services – They help companies develop satellites and payload systems. Also providing them with on-ground operational and software support. These are usually sold to governments on fixed contract prices.

Their costs (excluding depreciation of long-term assets/satellites) include:

Imagery, software data analytics – Internal labor used for software developing, third party data purchase, operations cost for ground stations and satellites, cloud & server hosting costs, stock-based comp for people working in supporting imagery and analytics and sales marketing costs are capitalized and then amortized based on the contract. It is a part of COGS.

Professional and engineering services cost – Internal labor cost for people designing/engineering systems, subcontractor costs for acquisition of materials, testing satellite components etc. and costs for customizing software services. It is also a part of COGS.

Operating expenses include – SG&A, R&D and depreciation & amortization.

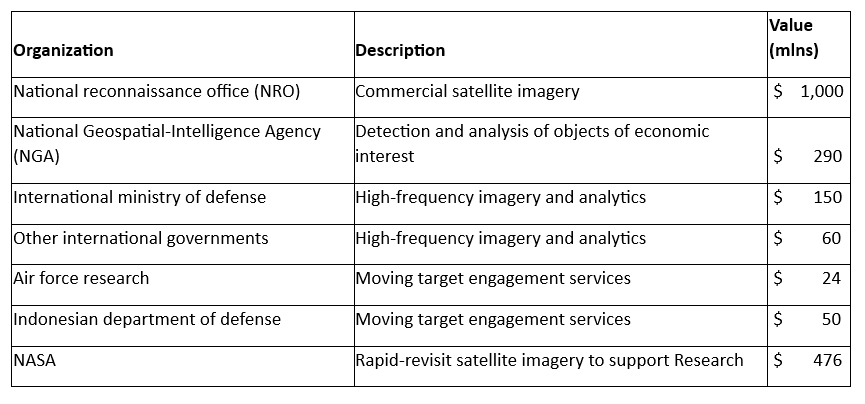

Currently, BlackSky have the following multi-year contracts:

In addition, three days ago BlackSky reported it had won “multiple rapid procurement contracts for its high-margin, core analytics services through the U.S. Space Force’s online Global Data Marketplace (GDM).”

It should be noted that government contracts are often on a ‘pay as you go’ format so that revenues need not reach their ceiling amounts. The duration of these contracts is also unclear. The NRO contract is for 10 years and the NGA contract is 5 years. The rest just say multi-year contracts

Financial Highlights

Blacksky’s revenue increased 45% in 2023 driven by increased imagery and analytics orders and several price subscription contracts with new domestic and international customers. They’ve seen a 51% CAGR sales growth for the period between 2020 and 2024.

For 9MFY24, revenue grew 22% YoY. 2024 revenue guidance was $102-118M (around 16% growth YoY) which is lower growth than other years. However, revenue growth should pick up with the launch of Gen-3. Analysts currently expect BKSY revenues to expand 26% in 2025 and 29% in 2026.

For 9MFY24, YTD cash operating expenses are the same: $48M (while revenues have increased 22%) demonstrating strong operating leverage. Cash + STI + restricted cash combined is $64M. As a result, the company will need to raise cash, ideally using equity.

On September 2024 BlackSky completed the sale of 11.5 million shares for a total of $46 million @ $4 per share average price (current price is $9.77+ and in the last year the price was around $8 and the lowest point was $4 in September 2024). Note - $4 is the average price. They sold around 3.5m shares for $1.45 in December 2022 and 500,000 shares for $9.68 in 2024. This $46m amount raised is before the deduction of $3.8m underwriting and other expenses.

Capex is expected to be $55-65M for the year 2024. The company has spent $40M in the first 9 months in capex this year. Capex spend last year was $43M, but the elevated capex is due to launch of Gen-3 satellites at the end of this year. We expect the capex to reduce going forward. They’ll have operational expenses for satellite launches and remaining capex for 4QFY24. If we assume they’ll spend $40M in operations next year, they’ll be left with 14M cash. They will need to raise money soon, so we can expect more dilution, unless they turn cash flow positive which is unlikely as satellite launch expenses will be incurred.

The company are aware of improvements in operational costs and predict their adjusted EBITDA for 2025 will be positive. Break even cash flow is getting closer. However, they tend to adjust or change their financial targets.so these need to be taken with a pinch of salt. For example, they have changed revenue forecasts many times.

The company has $42.6M net debt (debt + operating leases – cash). Around $7M in leases.

They have high depreciation, which is an issue but also a feature of the industry. Satellites and computer equipment/software have a useful live of 3 years. 85-90% of their depreciation cost is due to depreciation of satellites.

Company has non-cancellable leases for its properties till 2033.

All costs of satellites like materials, making, launching and other costs are capitalized and then depreciated on the basis of the life of the satellite.

The board of directors are very experienced, however all of them serve on multiple company’s boards which could lead to overboarding.

CEO Brian O’Toole, experienced in space tech sector.

CIO is responsible for risk management and strategies.

They have 2 offices Herndon, Virginia (leased till 2036) and Seattle, Washington (leased till 2033).

All companies in the industry are exposed to sudden major losses. For example, in 2021 BlackSky incurred a $18M satellite impairment loss because they lost 2 satellites. This is a high risk/high reward sector.

Valuation

To value BKSY we use certain factors like revenue growth, operating margins, sales/reinvestment to build assumptions in a standard DCF model.

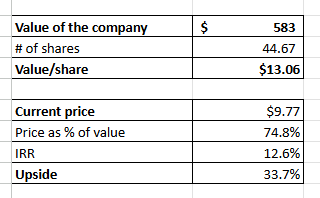

The company currently has -50%+ operating margins with 50%+ CAGR revenue growth since 2020. We give the company a 24% CAGR revenue growth rate based on an acceleration in growth following the launch of Gen-3. We also forecast operating margins transitioning from -50%+ to 9.5% (average of all US aerospace and defense companies), turning positive in year 4 (2028). With these assumptions we estimate the company is slightly undervalued (33.7%) with an intrinsic value of $13. We also used a sales/reinvestment of 2.5 ($2.5 of sales increase for every dollar invested, because cash flows will benefit from the investment they have already made in Gen-3 satellites) for the next 5 years. The sales/reinvestment then reverts back to the industry average of around 1.5.

This model is not to estimate the exact intrinsic value of the company, as the business is still young. Rather it is a way to reverse engineer the growth and margins needed to justify the current valuation. The model does, however, show that upside exists with modest assumptions.

Qualitatively, $300 million for this business seems reasonable given the optionality on offer. Even using price/sales, the company is still cheaper than its peers. Management has also stated it’s long-term target to achieve 20-30% revenue growth with >40% adjusted ebitda margins. Give the company 20% revenue growth for five years, adjusted ebitda margins of 20% and a 20 times multiple and BKSY should be worth in excess of $1 billion in 5 years time.

To sum up, we think the risk/reward turns favorable with the stock under $10 and moves to compelling if the stock moves under $8. That’s not to say this isn’t a risky stock. The likelihood of future share dilution and the possibility that something goes wrong in the future is high which means this should be treated as a small and speculative position.

Final Thoughts

The applications for high frequency satellite monitoring are myriad. From monitoring supply chain dynamics, tracking natural disasters, analyzing retail foot traffic, assessing insurance claims to making critical military decisions. BlackSky operates in an interesting space, with a lot of potential for growth and unique competitive advantages.

However, it is important to point out the uncertainties and flux in the industry. Surveillance and defense are not new industries, but the novelty is in how these companies collect the data, process it and then utilize it to provide analytics. BlackSky’s competitive advantages that differentiate them from competitors are low cost, high frequency surveillance and modern software interface (using AI and ML) to process satellite images. They have strong gross margins, good management, government contracts and are on the cheaper side compared to the competitors. There is also significant optionality that comes from operating leverage and the chance to capture commercial revenues. On the downside, shareholders will face some dilution because the company needs to raise capital to develop and launch satellites.

Thank you for reading! If you enjoyed this analysis please help us by clicking the “♡ Like” button.

Disclaimer: The information in this newsletter is not and should not be construed as investment advice. Overlooked Alpha is for information, entertainment purposes only. Contributors are not registered financial advisors and do not purport to tell or recommend which securities customers should buy or sell for themselves. We strive to provide accurate analysis but mistakes and errors do occur. No warranty is made to the accuracy, completeness or correctness of the information provided. The information in the publication may become outdated and there is no obligation to update any such information. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Contributors may hold or acquire securities covered in this publication, and may purchase or sell such securities at any time, including security positions that are inconsistent or contrary to positions mentioned in this publication, all without prior notice to any of the subscribers to this publication. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.