Research Notes: The Las Vegas Sphere

Sphere Entertainment might be the most intriguing stock in the market

Highlights:

Sphere Entertainment has built possibly the most unique venue in modern history — which makes the stock both fascinating and extraordinarily difficult to model.

Management concerns are real, and it’s possible the legacy MSG Networks business turns out to be an albatross.

Valuation is reasonable if an investor believes in the product. There’s some reason to do so — and even to look beyond possible red flags.

It’s hard to think of a more unique stock than Sphere Entertainment SPHR 0.00%↑. The company’s flagship Sphere venue in Las Vegas is unlike anything the world has ever seen. It cost over $2 billion, sparked fascination, and potentially underpins a franchise model that could see Spheres — and mini-Spheres — constructed around the world.

source: Smithsonian Magazine

Those facts alone make Sphere stock an intriguing investment. But there’s a very real, and complicated question: how much money will this project actually make? Even the company’s chief executive officer has been relatively circumspect on that question, because he doesn’t know.

After all, it’s not just the building that is unique. The nature of the model (multi-week residencies, kicked off by a 25-show booking from U2) is different from that of other venues. Sphere is designed to run 7 days a week, and during the day as well: the venue currently is showing Postcard From Earth, a documentary for which tickets start at $69. The Sphere can book significant advertising revenue as well, with a one-week campaign reportedly costing $650,000.

There are so many ways this story can play out. The Sphere concept could be a massive innovation that drives interest for decades. The original venue provides adequate returns on its $2.3 billion price tag; franchise revenue provides consistent profits; and SPHR stock is a huge winner. It can also be something of a white elephant, in which the initial buzz wears off, costs prove higher than expected (something that already happened with construction), and profits disappoint. In that scenario, franchise opportunities dry up, and the company’s impact is limited to being a second-rate attraction for Las Vegas tourists.

At the moment, there’s a great deal of uncertainty. But this is a fascinating stock, one with a legitimate, fundamental, bull case.

Who Own’s Sphere Entertainment?

Sphere Entertainment is the end result of quite a bit of re-shuffling of the Madison Square Garden empire. The company’s history in some form dates back to the 1920s, when it was founded to operate the third Madison Square Garden in New York (the fourth is the arena now standing, near Penn Station). MSG eventually came to own the eponymous arena, the New York Knicks and New York Rangers, and other assets. In the 1970s, MSG was acquired by Gulf + Western, one of the great conglomerates of the era (it also owned Paramount Pictures, and for a time video game manufacturer Sega).

Gulf + Western eventually became Paramount Communications, which sold to Viacom, which sold MSG to Cablevision and ITT; Cablevision took over sole ownership of the business in 1997. Cablevision had been founded by Charles Dolan; two years later, Charles’s son James was named chairman, and took control of the Knicks and the Rangers.

source: AP

In 2010, Cablevision spun off MSG into a standalone company. In 2015, MSG split into MSG Networks — focused on the company’s cable network in the New York area — and The Madison Square Garden Company. In April 2020, the latter business again split, into MSG Sports MSGS 0.00%↑, which kept the sports teams, and MSG Entertainment, which focused on live music and was developing an innovative venue in Las Vegas to be called the Sphere. The following year, MSG Entertainment re-acquired MSG Networks in an all-stock deal. And then, earlier this year, MSG Entertainment MSGE 0.00%↑ was spun off from that business, with the remaining portion renamed Sphere.

At the time, Sphere consisted of several assets, including a one-third stock in MSGE, majority ownership of Las Vegas club operator the Tao Group, MSG Networks, the Sphere, and land in London. The MSGE and Tao assets have been monetized, leaving just the Networks and Sphere businesses.

As of September 30th, Sphere had $451 million in cash on the balance sheet. There is just over $1.2 billion in debt, but importantly $930 million of that figure is secured by MSG Networks, and is non-recourse to the Sphere Entertainment parent. At Wednesday’s close of $36.03, Sphere has a market capitalization of $1.27 billion, putting its enterprise value just shy of $2 billion.

The Background Matters — Because Dolan Is In Charge

Right now, Sphere is mostly a qualitative story. The venue’s first concert was held on Friday, September 29, so the most recent quarterly report (Sphere’s fiscal first quarter) includes two days of revenue in the Sphere segment. (For what it’s worth, Q1 revenue was $7.78 million, and the adjusted operating loss was $83 million.)

Because of that fact, the background of Sphere Entertainment does matter — particularly because James Dolan controls Sphere through his ownership of Class B supervoting stock. And, at this point, Dolan’s control of the company probably should be considered a negative.

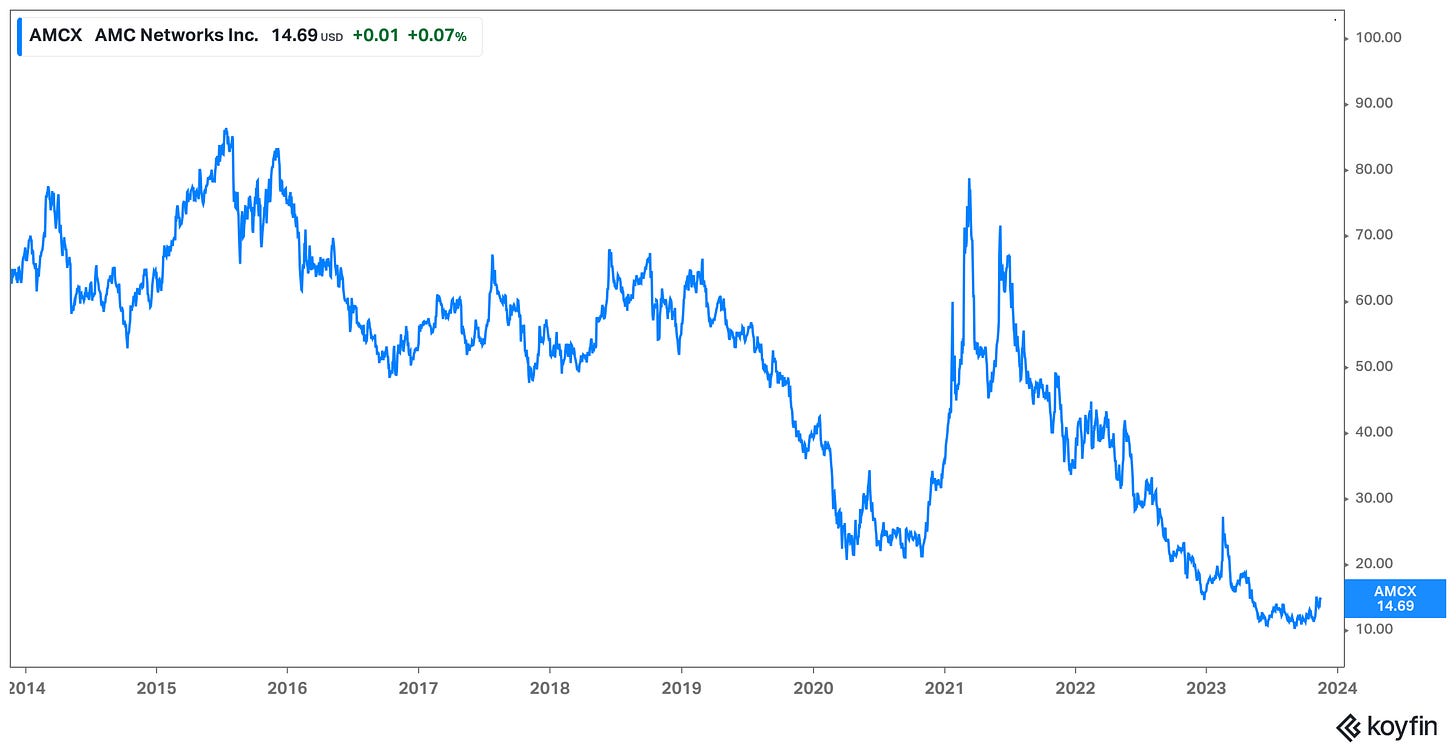

Dolan has similar control of MSGS, MSGE, and AMC Networks AMCX 0.00%↑ . None of those investments have been particularly good — AMCX in fact has been a disaster in recent years — and on the whole the MSG complex has underperformed since the spin from Cablevision1.

source: Koyfin

To be fair, those businesses have been driven by factors outside of Dolan’s control. Cord-cutting crushed AMCX and hit MSG Networks; media rights paid to pro leagues boosted the value of the Knicks, in particular (and to a lesser extent the Rangers). The live music overall seems to have grown reasonably well, but there too one can question the importance of management in running what is trademarked as “The World’s Most Famous Arena”.

But aside from the various stock charts, there are real concerns here. Dolan probably had the opportunity to sell AMC Networks before cord-cutting, and the inevitable tapering of The Walking Dead franchise, tanked the stock. He didn’t; a long-rumored courtship of Starz never occurred, either (whether that’s good news or bad news, relatively speaking, is difficult to say in retrospect).

As an owner of the Knicks and Rangers, Dolan is now among the most-disliked owner by his own fanbases in all of sports. One columnist in 2019 cited “the unflattering paranoia and pettiness” that dominated the Knicks’ basketball operations, after Dolan had a fan banned from the arena for heckling. Even Bloomberg, that same year, asked if Dolan was the worst owner in pro sports. Four years later, the Knicks admittedly have improved, but Dolan’s reputation mostly has not; the one modest positive is that he seems less involved in the team’s operations. (Dolan, however, was accused of screwing up the Rangers’ long-term plan in 2021, after years of facing similar criticisms surrounding his stewardship of the Knicks.)

That reputation bled over into Sphere just before last week’s earnings report. Sphere’s chief financial officer, Gautam Ranji, had resigned suddenly, and unusually, just days before the release. Last Monday, the New York Post reported that Ranji’s departure came after he was screamed at by Dolan in a meeting. On the Q1 call, Dolan didn’t confirm the report — he said “we both came to the conclusion that it probably wasn’t a great fit” — but he didn’t deny the reporting, either.

One positive in favor of Dolan’s involvement in Sphere is that he legitimately seems to care about music in a way that might not quite be the case with sports. (Dolan told the New York Times in September that “I don’t really like owning teams”.) Dolan famously (or infamously) heads a band called JD & The Straight Shot. As the Times profile noted, the Sphere is his creation from the jump, and a way for the 68-year-old owner/chief executive officer to develop a project that didn’t originally belong to his father (or his father’s companies).

But the history of the MSG complex suggests that being a minority shareholder in a Dolan venture has its risks. The 2021 re-acquisition of MSG Networks led to claims of self-dealing, and a lawsuit that eventually was settled for $85 million. That in turn creates a potential stumbling block to an aspect of the SPHR story that might well have fundamental importance.

The Sphere brands. Source: sphereentertainment.com

A Conflict Problem

The 2021 all-stock merger between MSG Entertainment and MSG Networks valued the latter business at about $920 million. As noted above, there is currently $930 million in non-recourse debt secured by MSG Networks.

In a cord-cutting environment, then, there is an argument that Sphere’s ownership of Networks is a good thing — a free option. If Networks struggles, then Sphere can simply walk away from its debt, and hand the business over to the lenders. In theory, there should be no scenario in which Networks’ value, less that $930 million debt, is negative.

But in practice, MSG Network is the broadcast partner of the Knicks and the Rangers — which Dolan also owns. And so the controlling shareholder may not want, say, an aggressive private equity firm to acquire the network in a restructuring, and face the very real prospect of brinkmanship over affiliate fees. One obvious problem is that such brinkmanship often is based on public opinion — and, again, the public opinion of Dolan in New York is exceptionally negative.

The bigger problem, however, is that MSG Networks’ agreements with the Knicks and the Rangers run through 20352 — and keep going up annually even as subscribers go down. Rights fees were $172.6 million in FY23, and $147.5 million four years earlier. Should MSG Networks go into bankruptcy, that agreement ,most likely ends. And with it, so do potentially tens of millions of dollars in revenue for the Knicks and Rangers3.

This is an important issue for the stock. With a little over 35 million shares outstanding, it doesn’t take a huge divergence between the value of Networks and the face value of its non-recourse debt to have an impact on fair value of several dollars per share.

Is Networks A Negative?

And there does appear to be a divergence. In fiscal 2023, the Networks segment generated adjusted operating income (the metric published by most companies as Adjusted EBITDA) of $169 million. The figure fell 18% year-over-year. Incredibly, it’s barely half the figure from fiscal 2019.

The problem is what Sphere calls “affiliation fee revenue” (other companies use the term “affiliate fee”): revenue generated from cable and satellite subscribers who pay to carry MSG Network. In fiscal 2019, MSG Networks disclosed that 90% of total revenue came from affiliation fees, suggesting $617 million in affiliation fee revenue. Sphere now says a “significant majority” of total revenue comes from affiliation fees, but also has disclosed a loss of $116 million in just the last two years.

Essentially all of that lost revenue comes off profit. And costs are going to grow, because media rights fees accounted for 84% of operating expenses last year. That excludes the benefit of cost reimbursement from MSGS for corporate overhead, which was $30 million last year. As a result, Networks operating income declined 24% year-over-year in Q1; a similar full-year effect would drop AOI this year to ~$128 million.

There is no world — none — in which the Networks business is worth $930 million. This is a business in secular decline. Subscribers in FY23 dropped 10.5%, and that excludes the impact of Comcast CMCSA 0.00%↑, which no longer carries MSG Network at all. The company is offering a digital package to cord-cutters, but as we discussed with Disney DIS 0.00%↑, the power of the sports network model used to be the ability to generate millions of dollars in annual revenue from people who never watched the network.

There aren’t direct comparables, but AMCX trades at ~3.3x this year’s EBITDA. Diamond Sports Group, which operated regional sports networks, filed for bankruptcy, though its performance was somehow worse, with EBITDA plunging 78% in three years. Right now, Networks probably looks like it’s worth maybe $450 million: a high-3x multiple to fiscal 2024 EBITDA. If Dolan doesn’t allow for a restructuring, the unit has a value of negative $480 million — over $13 per SPHR share.

On the Q4 call, management was asked about the plans to refinance the term loan next year. Then-CFO Ranji spoke optimistically about the new streaming service, and a plan to sell single-game access for $9.99. For now, anyway, Sphere seems to think there’s still turnaround potential for the Networks business — but if they’re wrong, it’s likely to have a material impact on the SPHR stock price.

All That Said…Is The Sphere Transformative?

The analysis to this point admittedly has been mostly negative, for two reasons. First, to be blunt, the known facts about Sphere Entertainment largely are negative. And, second, this is a stock where it is important to understand the totality of the story — because it is quite easy to get carried away in the optimism toward the venue itself.

We have not been able to see the venue in person (to this point, neither pleas for subscriber edification or the promise of a tax write-off has been enough to secure a weekend trip to Vegas), but by all accounts the Sphere is mind-blowing.

Reports on social media seem absolutely glowing (pardon the pun); even each variation of the Sphere’s outdoor display generates thousands of posts across multiple platforms. As for the U2 residency, Fast Company wrote that the Sphere “sets a new standard for arena concerts”. Variety said the sound system was “more wonderful than anything we’ve heard in an 18,000 seat venue…Sphere’s team of inventors have created a system that micro-targets concertgoers.” And yet the reviewer still said the “most impressive moment of the Sphere show may be when you first walk in the room.”

Even skeptics are won over. Here’s how Charlie Warzel put it in The Atlantic [emphasis ours]:

I wanted to be cynical about the Sphere and all it represents — our phones as appendages, screens as a mediated form of experiencing the world. There’s plenty to dislike about the thing…But it is also my solemn duty to report to you that the Sphere slaps…It’s gaudy, overly commercialized, and cool as hell: a brand-new, non-pharmaceutical sensory experience.

Postcard From Earth too has received solid reviews: the Los Angeles Times called it “mind-blowing”. Overall, the initial reaction here seems to be that Dolan truly has found something. And he may have created something worthwhile and innovative enough to look past the red and yellow flags around the business.

What Is SPHR Worth?

It’s that sense of the Sphere being, well, awesome that makes SPHR compelling. And, if that sense holds, the numbers here absolutely can work.

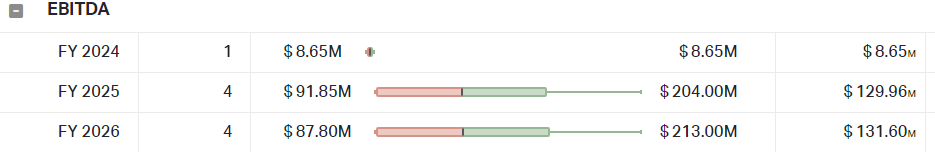

To be sure, it’s difficult to model profits. Even the Street is all over the place, with four estimates for FY25 and FY26 showing dramatically wide ranges:

source: Koyfin

Over at Twitter and Seeking Alpha, Kevin Mak has done deep work on the company, even counting concessions at a show. He sees a case for $200 million in Sphere segment Adjusted EBITDA in FY2025 (note that’s huge upside to the above models, which are for the company as a whole), and at a 15x multiple a $90 share price. (His model can be viewed via a link from this Tweet.) Mak does ascribe a zero to the Networks segment, owing to the non-recourse debt, but even assuming Networks winds up draining value his model obviously suggests tremendous upside from the current $36.

The problem with Mak’s model, however, is the same with any SPHR model right now: it’s garbage in, garbage out. The arrangement for performers in Sphere is different than, say, for Live Nation Entertainment LYV 0.00%↑ or larger stadiums; the company is negotiating revenue-share deals for its residencies. U2 reportedly is getting 90% of the face price, and thus earning over $1 million per show. Mak argues that subsequent deals may be better for Sphere, and also points to increased ticket prices for the daytime shows as a potential margin driver going forward.

Mak may well be right — but there’s a bit of a circular argument here. Sphere can negotiate better revenue sharing deals, and charge higher prices, only if the Sphere is as awesome as initial reports suggest. And even then, that may not work: there are only a handful of bands on U2’s level. What does Sphere’s negotiating position look like for, say, August 2025 when the buzz has worn off and the company has moved on to booking names that aren’t quite as big?

Again, these are unanswerable questions. But there is a simple, if intriguing, way to look at SPHR from a fundamental perspective. Again, the company has an enterprise value of $2 billion valuing the non-recourse debt in full. The Sphere cost $2.3 billion to build.

So, going forward, the investment case is simple: if the Sphere itself was a good idea at that cost, then SPHR is a good idea at this cost. Return on the capital invested in construction are enough to more than cover the current enterprise value, and there’s optionality from Sphere London (which still needs final approval), a restructuring or separation of MSG Network, and franchise opportunities beyond the first two locations.

Again, there are red flags but the concertgoers and “immersive experience” attendees don’t care about them, and if Sphere is the phenomenon it appears to be then investors won’t either. Right now, it looks like Sphere actually is a phenomenon — which probably means Sphere stock is a buy.

As of this writing, Vince Martin has no positions in any securities mentioned.

Disclaimer: The information in this newsletter is not and should not be construed as investment advice. Overlooked Alpha is for information, entertainment purposes only. Contributors are not registered financial advisors and do not purport to tell or recommend which securities customers should buy or sell for themselves. We strive to provide accurate analysis but mistakes and errors do occur. No warranty is made to the accuracy, completeness or correctness of the information provided. The information in the publication may become outdated and there is no obligation to update any such information. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Contributors may hold or acquire securities covered in this publication, and may purchase or sell such securities at any time, including security positions that are inconsistent or contrary to positions mentioned in this publication, all without prior notice to any of the subscribers to this publication. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

Given all the moves, it’s tough to track precisely how much it has underperformed, but MSGS has lagged the index, and MSG Networks was a dud before being re-acquired. Gains in MSG from 2010 to 2015 were solid but appear roughly in line with the market as a whole.

This is based on disclosures from MSG Networks as a standalone company, though it appears confirmed by the MSGS Q4 fiscal 2023 conference call. An analyst said the contracts were in force until 2035, and MSGS management did not disagree.

There are echoes here of our analysis on Ashford Hospitality Trust AHT 0.00%↑ from September. AHT looks tremendously undervalued thanks to a huge portfolio of hotels backed by non-recourse debt. But because its controlling shareholders have a much larger stake in Ashford Inc. AINC 0.00%↑, which gets management fees from AHT properties, they are incentivized against handing in the keys for properties not worth the debt they are securing.