The Bubble Has Burst, But It's Not Over Yet

History might be the biggest risk to this market, but there are still reasons to stay invested

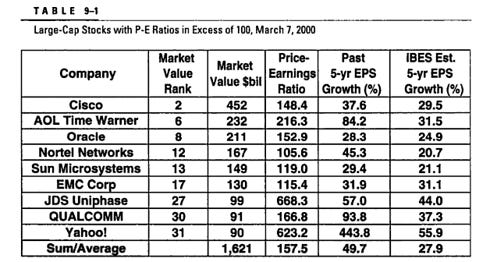

I don't believe the market can be consistently timed. But the market can be occasionally timed. At ultimate peaks, the insanity is obvious. Here’s an incredible table from an updated version of Jeremy Siegel’s Stocks For The Long Run, highlighting the craziness at the 2000 peak:

Anyone in that market with any sort of training or experience knew the end w…