The Case For Utilities In A World Of AI

Long power in an AI world seems like a simple trade; is it too simple?

Highlights:

Generative artificial intelligence and other trends are driving up forecasts for U.S. power demand. In theory, that should be a huge positive for utilities.

However, the market hasn’t reacted much: the major sector ETF has returned barely 11% over the past year.

The case isn’t as simple as you might think, but there’s a path for multi-year, double-digit returns from the sector.

Power Demand Will Rise

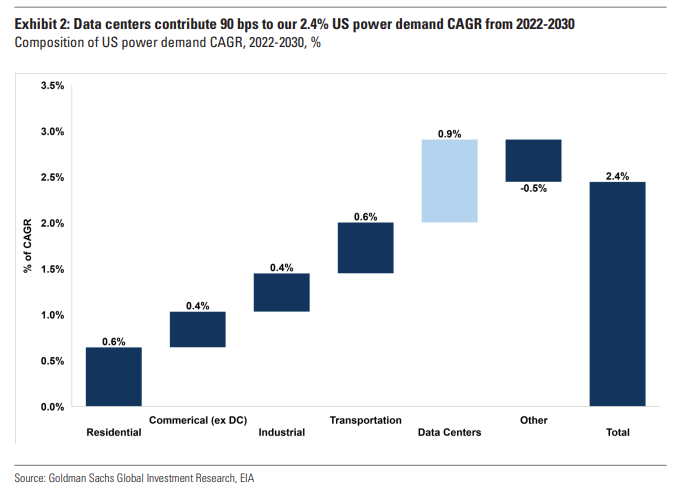

At the moment, it seems to be a unanimous opinion that U.S. power demand is going to rise. In an April report, Goldman Sachs forecast 2.4% annualized increases in power demand through the end of the decade, up from a 20-year rate of about 0.5%. Data centers are the largest drivers, but not the only one:

source: Goldman Sachs

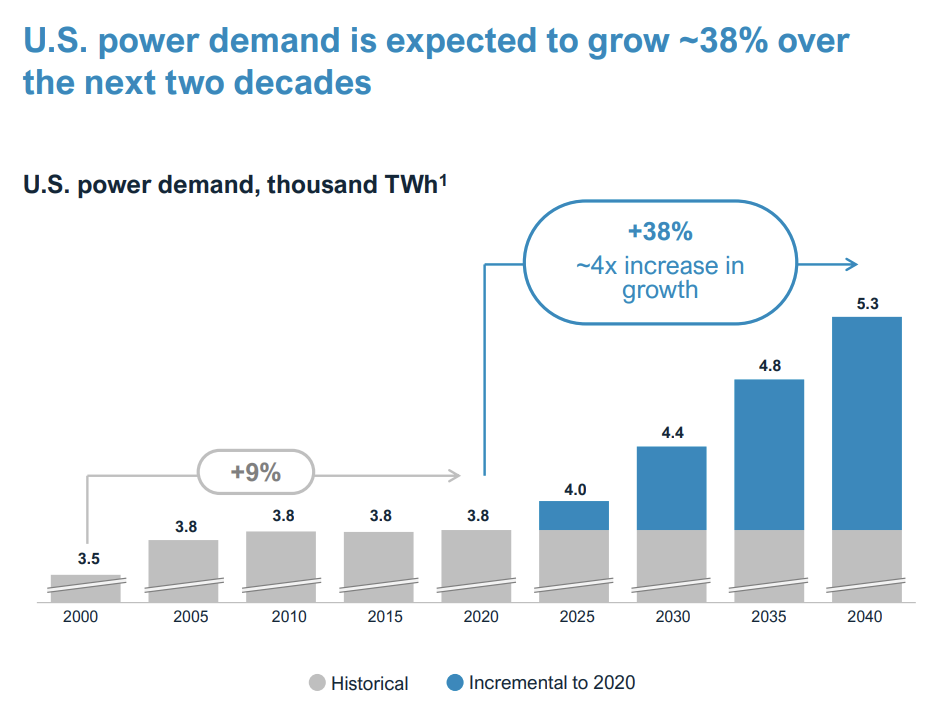

Utility NextEra Energy NEE 0.00%↑, the owner of Florida Power & Light along with a large renewables business, isn’t quite as optimistic. But NextEra still sees 1.6% annualized growth over the next two decades, with a clear step change from recent demand levels:

source: NextEra Energy 2024 Investor Day

Consultancy GridStrategies reviewed filings with the Federal Energy Regulatory Commission (FERC) and calculated that the five-year cumulative load growth forecast across the U.S. has nearly doubled, to 4.7% from 2.6%. When the report was written in December, the firm noted that higher outlook was “likely an underestimate”, given that the more recent the update, the greater the forecasted demand.

Of course, we’ve seen the equity market price in this growth, with names like Eaton ETN 0.00%↑, Quanta Services PWR 0.00%↑, and nVent Electric NVT 0.00%↑ soaring (to name just a few). And we’ve seen publicly traded companies — most notably the ‘hyperscalers’ like Amazon AMZN 0.00%↑ and Microsoft MSFT 0.00%↑ — plan for hundreds of billions of dollars in annual data center capex over the next decade. Given that a single data center has electricity usage approximately equal to that of 50,000 homes, that trend alone is going to be material to overall demand.

Certainly, efficiencies within the data center themselves (from liquid cooling, for example) can offset some of this growth. (As more than a few observers and industry participants have noted, AI itself can be used to lower the power requirements it requires.) But given that this isn’t just an AI story — data center growth will continue even for non-AI applications, manufacturing growth should continue to rise, EV penetration will increase, etc. etc. — it does seem like the case for a step change in power demand at this point is relatively solid.

The one caveat, of course, is a recession, which can have significant effects. In 2009, electricity demand dropped 4.2% in the U.S., the biggest fall in at least six decades.

Some Utilities Have Already Roared

That optimism, however, doesn’t seem to be priced into U.S. utility stocks. XLU has rallied sharply off October lows. But taking a longer view, that recovery is not that substantial; even on a total return basis, the ETF is below 2022 highs:

source: Koyfin

Forward earnings multiples haven’t changed materially (with one exception we’ll get to momentarily), and look relatively reasonable on an absolute basis as well:

source: Koyfin

But investors have already priced this thesis into a couple of utility plays. The third- and fourth-best stocks in the S&P 500 year-to-date, behind Nvidia and Super Micro Computer SMCI 0.00%↑, are Vistra VST 0.00%↑ and Constellation Energy CEG 0.00%↑. Independent power producer NRG Energy NRG 0.00%↑ is 13th.

All three are clear AI power plays. Each owns nuclear assets; each can provide the electricity — and importantly, the clean electricity — demanded by the hyperscalers as they build out their AI datacenters.

Here, the market is clearly pricing in increased demand and, likely, higher prices as well. All three stocks have more than doubled over the past year. VST in fact is the best performer in the index over that span, ahead of SMCI and NVDA.

Yet in the rest of the sector, investors seem to have mostly shrugged. The 11.5% gain in XLU over the past twelve months isn’t bad, but it’s not much better than the long-term returns (9.5% annualized for the previous 20 years). By our estimates CEG and VST alone probably account for ~five points of that gain.