The Contrarian Case For CarMax Stock

The cycle is turning against CarMax. It's worth buying anyway

TLDR:

Used car dealer CarMax is headed for a few challenging quarters, at least.

The industry benefited from the pandemic but is now facing multiple headwinds.

Even in that context, a stunning decline implies CarMax’s business is less attractive than even pre-2020.

That sentiment appears far too bearish, and long-term, is likely to reverse.

At the moment, it would seem delusional to even consider a long position in CarMax KMX 0.00%↑, let alone actually own the stock. The Q3 report late last month badly missed consensus estimates, with earnings per share declining 54% year-over-year.

The used car market is clearly headed for trouble, with higher interest rates raising financing costs for customers ahead of a widely-feared recession. That comes after a period of stunning prosperity, in which used car prices actually appreciated instead of depreciated. As Barron’s put it after CarMax earnings, “the used-car boom is over”.

Investors have fled. KMX on Friday closed at its lowest level since April 2020, after tanking during the early weeks of the pandemic. Shares last week declined 7.5% while the S&P 500 was up 4%.

But from a long-term perspective, all these reasons to stay away are precisely what creates the opportunity.

source: CarMax

The Nation’s Largest Used Car Dealer

CarMax is the largest used car dealer in the U.S. in terms of annual units sold. The company has more than 230 locations across the country:

source: CarMax

The company was founded in 1993 as an antidote to what was seen as a disreputable used car industry. (An interesting piece of trivia: CarMax was originally developed by Circuit City, an electronics retailer which filed for bankruptcy in 2008. CarMax tracking stock was first issued in 1997; the company was officially split off in 2002.) The CarMax model centered on a fixed-price, “no haggle” policy which remains intact to this day.

The used car market in the U.S. is large, with estimated retail unit sales of 40.9 million in calendar 2021. That market is extraordinarily fragmented: CarMax estimated earlier this year that, of vehicles 10 year olds or newer, it had market share of just 4.0%. That slim figure still leads the industry (and is up ~50 basis points from CY20), with Carvana CVNA 0.00%↑ in second place, followed by AutoNation AN 0.00%↑ and Penske Automotive Group PAG 0.00%↑.

What The Market Is Telling Us

There’s not a ton of mystery to the CarMax business model. It buys used cars from individuals (including via “instant offers” online) and wholesale auctions. It sells cars to individuals, often financing the purchase, and moves some inventory back to wholesalers. It captures a spread in the process.

So there’s not a lot of mystery as to why KMX stock is down 57% this year. Demand for used cars boomed amid the pandemic, thanks to flush consumers and supply-chain bottlenecks decreasing the supply of new vehicles. Vehicle production is starting to normalize, returning the smaller new car market (historically ~40% of the used market by volume, give or take) to a stronger competitive position.

At the same time, interest rates have spiked, increasing financing costs for consumers. A potential recession could further pressure demand, even with results already under strain. As noted, CarMax's Q2 earnings fell by more than half year-over-year, and Wall Street now sees a 40%-plus decline for the full year.

Again, there’s no mystery about the near-term risks. Specific timing aside, there’s really little surprise, either. It was obvious even anecdotally that the used car market was frothy last year. That aside, this is a cyclical industry.

But in context the enormous decline in KMX (the stock is down 47% in less than ten weeks) suggests much more than short-term challenges. On an absolute and relative basis, the current CarMax stock price is a signal that the business has been materially weakened from a long-term perspective.

The simplest point to make is this:

CarMax’s debt is a factor, but only a modest one. Since the end of 2019, the company's enterprise value1 has declined 28%.

Now, there’s anchoring bias at play there, and perhaps a bit of cherry-picking, as KMX stock had a strong 2019, gaining 40%. But since the beginning of that year, KMX is down 11%. Enterprise value is roughly flat over that nearly five-year stretch, and remember that the fourth quarter of 2018 came awfully close to being a bear market. KMX still trades under its low from that year, and 32 cents above its low from 2017.

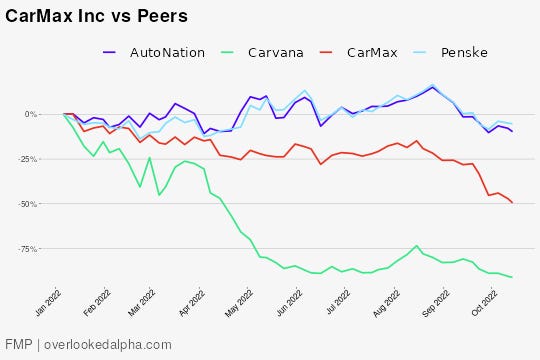

Let’s move on to relative performance:

The disastrous Q3 earnings report from CarMax has brought down the space with it. Both AN and PAG were roughly flat year-to-date until that release.

But KMX, which had underperformed to begin with, has lagged its credible peers since. (We recommended a short of CVNA back in April, and though we called for a cover far too soon, our bearishness toward that stock and that business both remain, for reasons we’ll discuss shortly.)

Simply put, KMX at $56 only makes sense if the business a) is worse than it was before the pandemic and b) worse than its peers after it.

Are These Businesses That Different?

There is potentially some logic to the outperformance of AutoNation and Penske. Both are rather different businesses, generating roughly one-quarter of gross profit from new car sales and about one-third from parts and services. That latter proportion seems particularly important from a defensive perspective ahead of a possible recession.

But, on the whole, there’s not a lot of reasons why these business should trade all that differently. Reliance on finance income is roughly similar: ~20% of gross profit2 for CarMax in FY22 (ending February) versus 28% for AutoNation and 20% for Penske.

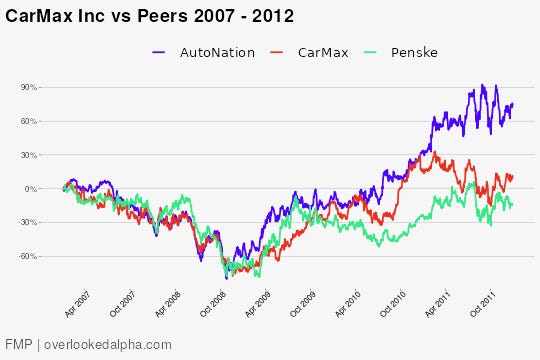

And while parts and services revenues are somewhat defensive, new car sales historically have not been. From 2006 to 2009, for instance, per data from the Bureau of Transportation Statistics, new car sales fell 36% by units and 27% in dollars. Over the same period, used car sales declined just 17% and 11%, respectively.

Net/net, even with different business models, the macro and interest rate sensitivities of these businesses should be in the same ballpark. And, indeed, during the financial crisis the three stocks moved somewhat in tandem:

This Time Isn’t Different Enough

There are reasons why this time might be different. The used car industry had a huge advantage post-pandemic, though new car margins expanded as well. That advantage is set to reverse, creating a near-term headwind.

Longer-term, supply constraints in late 2020 and 2021 will impact the used car market years from now, particularly for the higher-end, later-model vehicles that appear to do particularly well for CarMax (an average selling price of over $26K last year and $20K-plus the year before).

Electric vehicles subsidies will flow to new car dealers, but not CarMax. A (possibly) increasing split of haves and have-nots in an inflationary environment might favor new car dealers over their used car counterparts.

Most notably, used car valuations likely have further to drop. CarMax ended Q2 with $4.6 billion in inventory, about half its current market cap. AutoNation’s inventory is about 35% of market cap, and Penske’s 40%-plus; each figure includes contributions from new vehicles as well, which presumably are not headed for quite the same pricing pressures. Price cuts on existing inventory suggests a potential headwind to free cash flow for the sector, but the biggest pressure would be on CarMax.

Overall, there’s a case that the underperformance by KMX seen through the first nine months of the year makes some sense. But after this recent decline, we’re not talking some underperformance. We’re talking 40-plus percentage points YTD.

And, notably, there’s one competitor not yet mentioned: Carvana. CarMax’s upstart rival has posted exponential growth, going from zero to second place in the used car market in a decade. It’s been aggressive in buying vehicles (we were stunned by what they paid for my wife’s vehicle) and aggressive in pricing them.

Carvana clearly is headed for trouble. Its unsecured notes maturing October 2025 yield 24.5%. Bankruptcy is not guaranteed, but Carvana’s aggressive marketing and focus on revenue over profitability has to come to an end. That should be good news for CarMax, and a modest offset to the challenges facing the industry as a whole.

Again, the short-term outlook is bleak, with lender Ally Financial (ALLY) too posting disappointing results last week. But the broader, longer-term point here seems to hold.

CarMax has been an attractive business since its founding: at the start of 2020. Compound annualized returns were nearly 10% going back to the 1997 formation of the tracking stock, and nearly 15% since the 2002 spin-off. There’s little reason to believe that the positioning of the business has changed all that much, whether relative to new car peers or used car rivals.

Modeling KMX

Fundamentally, there needs to be a significant change, because KMX is trading at a notable discount to past levels. This is a business that historically traded in the 16x-20x earnings range. It now trades at 17.3x an eps of $3.22. That the low estimate for FY24 with the high being $5.64.

Whether that low estimate is correct is not really the point. What’s important is that CarMax’s trough earnings don’t have to be that low relative to the peak. CarMax no doubt is overearning to some extent, but it’s not as if performance over the past few years showed some exponential inflection. Between FY19 and FY22, unit sales rose 23% — total. Gross profit per unit barely budged (+1.4%).

The big jump came in finance income, which moved to a clearly unsustainable $801 million in FY22 from $439 million three years earlier. Finance (CAF) profits are down 12% so far through the first half of FY23, and more pressure is likely on the way.

On those lines, a macro-driven reversal is not necessarily likely to be that severe. Gross profit per unit (GPU) should hold up, since CarMax’s scale and Carvana’s weakness don’t suggest incremental competition on pricing. (Independent operators are unlikely to move the needle, even in such a fragmented industry; they simply won’t be able to.)

There’s one big concern fundamentally: SG&A (selling, general and administrative expenses). CarMax’s operating expenses have increased substantially. SG&A has cleared 70% of gross profit in each of the last two fiscal years after creeping up to 64% before the pandemic. The figure then increased another 17% in the first half.

There’s certainly some room for improvement here. Much of the spending to some degree has been to blunt the rise of Carvana as well as ‘no haggle’ models from AutoNation and others. Advertising expense increased 49% in FY22 against a 23% increase in retail units sold. CarMax is also investing in technology to build out its omnichannel model, which accounted for 56% of units in FY22 (with 9% of total units transacted completely online). The incremental need for that spend will moderate with the company’s platform now built out.

But CarMax also appears to have overshot in terms of demand. Staffing expense has been a big component of the rise in opex, and advertising spend can be reduced amid lower demand and fewer dollars spent by struggling rivals. SG&A dollars were down in Q2 vs Q1, and management seemed confident on the Q2 call that there would be more room for improvement if necessary. And it’s not as if competitors — large or small — will be able to dodge their own inflationary pressures. At some point, the industry’s gross margin per unit may simply have to come up in order to keep operating profits positive.

On paper, near-term earnings could take a big hit. Financial-crisis era unit sales of 35 million, ~flat market share, and flat GPU suggest retail gross profit in the range of $1.5 billion. Add $400 million in CAF and wholesale gross profit (each back to pre-pandemic levels) and FY23 SG&A (which excludes depreciation) is barely covered. Depreciation and interest expense put CarMax into the red on a net basis.

That’s a model, however, that assumes everything goes wrong and that CarMax doesn’t respond, or benefit. A market in which CarMax can’t make money is a market in which no one can make money. Plunging unit sales can likely be offset by increased market share. That is indeed what played out in FY09 and FY10, and CarMax’s omnichannel model is more attractive to buyers and more competitive against independent firms than was the case during the crisis. Advertising and staffing spend will come down amid lower demand and lighter competition.

The more pressing question is what will mid-cycle earnings look like. Even assuming some SG&A inflation, the answer still seems to be nicely above $3. FY19 EPS was $4.77. Hold all else equal and move SG&A to the midpoint of FY23 and the normalized figure sits right about $3. Again, it seems too conservative to hold all else equal. There are levers here to pull, and continued market share gains to take.

Why Now?

Given thin margins and imperfect peers, investors can have different views on the fundamentals here. But the sharp decline of late means that from a long-term perspective, KMX has an attractive valuation. A market multiple for historically solid return on equity and long-term performance, against a conservative estimate of mid-cycle earnings looks a good deal to our eye. The used car market in the U.S. is moderately cyclical, but it can’t fall off the cliff. For better or worse, automobiles are largely required in this country.

And as the largest player in the space, CarMax is either going to take pricing or take share, as has been the case for its two decades as a standalone company. That includes the financial crisis, which at the time was the most challenging period for the automotive industry in at least a generation. The headlines are awful now, but the news is not as bad as investors seem to believe. Getting this business at this valuation seems like a long-term win.

Admittedly, that leaves a key question: why now? There’s an obvious “falling knife” risk at the moment. Penske and AutoNation report this week, and presumably soft reports could send KMX down further still. Beyond this earnings season, the next few quarters are going to be ugly.

Those concerns are valid. But it’s worth noting that KMX (and peers) bottomed months before the market did in March 2009. Selling CarMax puts look intriguing with solid 20%-plus annualized returns or an entry point in the mid-40s or better (I’m likely to put on a version of that trade this week). There’s a case for a long KMX / short AN (or PAG) pairs trade, given relative performance year-to-date and a still-present disconnect between expectations for the new and used car industries. (Supply improvements are not likely to be enough to offset demand destruction. Again, if the downturn is that severe, new car demand will fall further.)

But there’s also a case for simply owning KMX here. This is a historically well-run business with significant market share to take: the company has targeted 5% by FY26, and even getting halfway to that goal matters. From a unit sales perspective, the industry is more defensive than investors might realize. Industry pricing went nuts in recent years, but industry margins did not. Competition is going to get weaker. SG&A will be cut.

This simply looks like an excellent business facing short-term problems. Investors can debate what the numbers will look like in FY24, but that debate is not all that material. What really matters is what CarMax looks like on the other side of these challenges. We think it will be nicely profitable — and have a much higher share price.

As of this writing, Vince Martin has no positions in any securities mentioned. He plans to initiate a long position in KMX this week, either via options and/or a straight purchase. He may also hedge that trade with a short position in AN, PAG, or other securities.

Disclaimer: The information in this newsletter is not and should not be construed as investment advice. Overlooked Alpha is for information, entertainment purposes only. Contributors are not registered financial advisors and do not purport to tell or recommend which securities customers should buy or sell for themselves. We strive to provide accurate analysis but mistakes and errors do occur. No warranty is made to the accuracy, completeness or correctness of the information provided. The information in the publication may become outdated and there is no obligation to update any such information. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Contributors may hold or acquire securities covered in this publication, and may purchase or sell such securities at any time, including security positions that are inconsistent or contrary to positions mentioned in this publication, all without prior notice to any of the subscribers to this publication. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

EV here excludes non-recourse debt, which is secured by auto loans receivable.

CarMax reports finance income as a separate line item, so our 20% figure here is calculated as (finance income) / (gross profit plus finance income).

It's possible that the never-ending shortage of automotive semiconductors may be ending. I know nothing about the auto sector, but that's likely very bad news for the OEMs because pricing and margins entering a consumer-led recession? This could be the straw that finally breaks TSLA?

I'm wondering if you're better informed on the semiconductor shortage and its implications?