The Most Impressive Stocks Of 2023

We take a look at companies that thrilled investors and outperformed the market

For the second year in a row, we’re posting our list of the most and least impressive stocks. We’re doing it slightly differently this year: breaking it up into two articles to provide some light(ish) reading over the holiday season.

This is not just a list of the best- and worst-performing stocks. If that was the case we could include biotech Soleno, with returns of 1,719%. But biotechs are notoriously risky, and there is luck involved. We’ll give Soleno credit where it’s due, but not necessarily a spot on this list.

Instead, we’re calling out companies whose performance stands out for reasons beyond the stock chart — both positively and negatively.

A Quick Review of Our 2022 List

Our four most impressive stocks of 2022 have posted mixed performance in 2023:

Energy drink purveyor Celsius Holdings has been called the new Monster Beverage. Monster famously has been the best stock of the past 25 years. CELH is now up 4,343% since the end of 2018 after gaining 42% so far this year. Anecdotally, the product seems to be everywhere, and a new distribution deal with Pepsi seems to be working out exceptionally well. CELH didn’t quite make this year’s list, but even with a market cap above $11 billion, we wouldn’t bet against the stock.

Retailer J. Jill made the 2022 list simply by appreciating 17% in a brutal year for the industry. A flat performance in 2023 also seems impressive, at least in comparison with other specialty retailers.

Software business Box got credit last year for showing profitable growth. But the company this year is missing the “growth” part. Full-year revenue is guided to increase just 5%, and BOX is down 17% this year, erasing most of its 2022 gains.

Super Micro Computer rode a turnaround to an 87% rally last year. This year the artificial intelligence wave has been much bigger. SMCI is +268%, the 16th-best performance of over 1,000 stocks with a market cap above $2 billion.

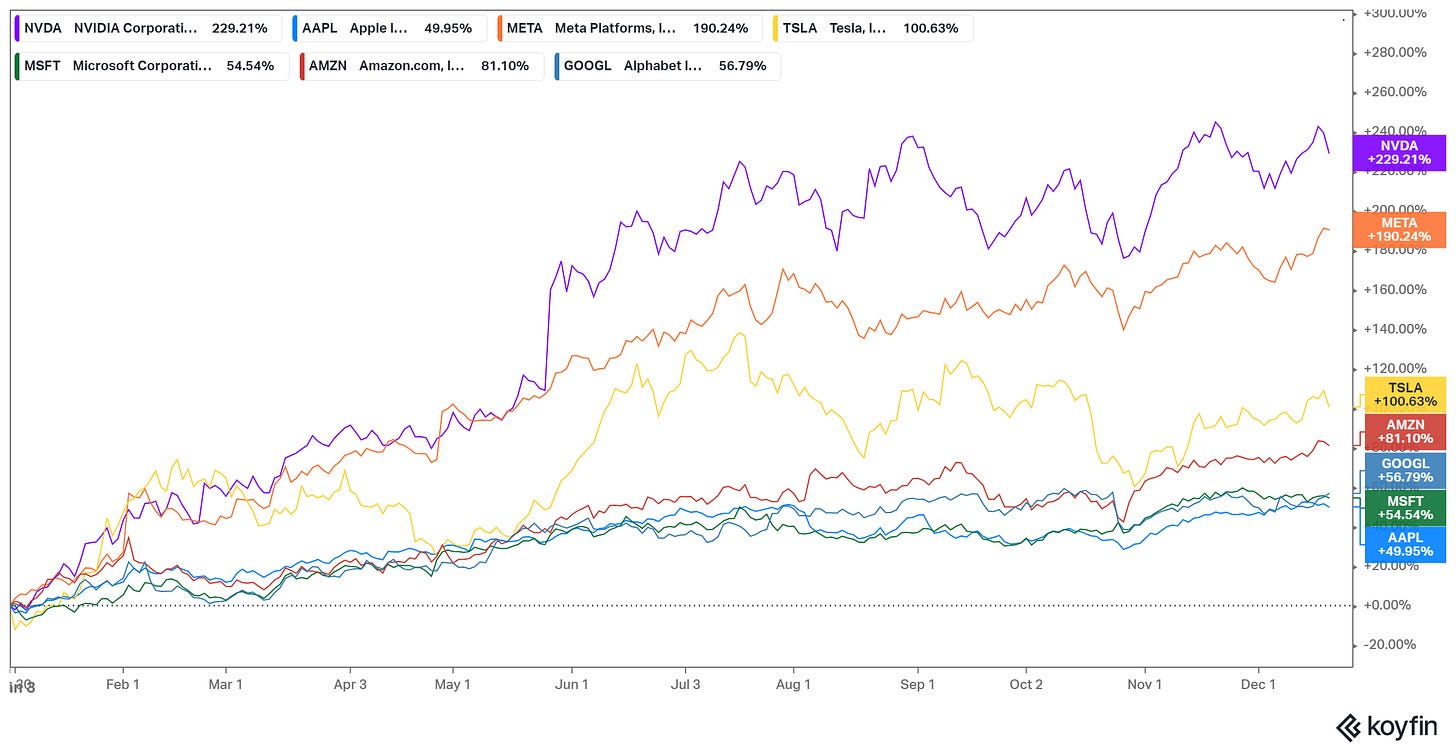

Nvidia

In pretty much any other year, Nvidia would be the no-brainer top choice on this list. But in a year dominated by the “Magnificent 7”, which has generated nearly half of the 23% gain in the S&P 500, Nvidia’s outperformance isn’t quite so obvious.

source: Koyfin

Still, it’s been a hugely impressive year so far with the company has adding $835 billion in market capitalization. At the moment, only five other companies have a higher equity value1.

Incredibly, two of those companies have actually outperformed Nvidia in terms of equity value gained. We calculated the 12 largest calendar-year gains in terms of market capitalization in history2; six came this year:

Microsoft 2023* - $986 billion

Apple 2023* - $971 billion

Apple 2020 - $971 billion

Nvidia 2023* - $835 billion

Alphabet 2021 - $756 billion

Amazon 2023* - $739 billion

Amazon 2020 - $735 billion

Tesla 2020 - $703 billion

Meta Platforms 2023* - $699 billion

Apple 2021 - $672 billion

Alphabet 2023* - $611 billion

Apple 2019 - $602 billion

Against Microsoft and Apple, who have both had stellar years (share prices +50% and +55%, respectively), Nvidia’s 229% gain gives it the edge.

Indeed, perhaps the only other year in recent memory that tops Nvidia’s 2023 is Tesla’s 2020. Tesla stock that year gained 744%. Incredibly, its market cap rose tenfold (remember that the company issued stock three times that year, the first time at a split-adjusted $51 against a current price nearly five times as high.)

Where Nvidia stands out, too, is in the fact that its performance has, without exaggeration, changed investing. The company’s blowout earnings report in May, in which it provided guidance of $11 billion3 against analyst consensus of $7.2 billion, was simply stunning. We wrote at the time that “artificial intelligence is now permanently part of the investment conversation going forward,” and six-plus months later that analysis still stands. For essentially every stock in every sector, AI has to be considered, whether as a benefit to growth, a threat to the future, or a way to drive down costs/better serve customers.

Nvidia’s Q1 report was such a game-changer that, even against stiff competition, the company still looks like the most impressive of the year.

Meta Platforms

In pretty much any other year Meta Platforms would be a no-brainer choice for the top of this list. The stock is up 190% year-to-date and its market cap is up a cool $700 billion.

In retrospect, the rally simply seems so obvious. META closed at $89 in early November of last year. It’s nearly quadrupled in the thirteen and a half months since. It seems insane that investors really believed that Mark Zuckerberg was going to run his company into the ground, by spending billions on virtual reality with no mind, ever, for shareholder value.

But if you look back at the Q3 2022 report that sent META to the lows, a rally of any size was not necessarily preordained. The stock was cheap, yes: on an enterprise value basis, it traded at about 10.5x eventual 2022 cash flow. But given long-running fears that Facebook usage had peaked, an ugly advertising environment (which had the potential to get worse), and Zuckerberg’s ‘full speed ahead’ approach to virtual reality, the market wasn’t necessarily being stupid or panicked. There were real concerns about the stock at the time.

The market clearly overreacted but it’s also worth pointing out how much has changed since then. In the Q3 release in 2022, the company guided for 2023 total expenses of $96 billion to $101 billion. At the midpoint, that was a $12.5 billion increase year-over-year. And that was after a quarter in which revenue declined 4% year-over-year.

A year later, excluding restructuring costs, Meta expects operating expenses of $83.5-$85.5 billion. That’s a near 4% reduction year-over-year. After Q3 2022, Meta projected a nearly 15% increase. Meanwhile, revenue has roared back (+12% year-to-date, +23% in Q3), and somehow usage is still increasing: Meta reported monthly active people of 3.96 billion in the third quarter of this year, up 7%.

Operationally, this has been an excellent year, and that, more than the late 2022 sell-off, is why META has been one of the best stocks in the market.

Carrols Restaurant Group

Carrols Restaurant Group (TAST) went public in December 2006, at a price of $13 per share. It was the company’s second go-round on the public markets: Carrols’ first IPO was in 1969, when the business then operated under its own brand. In 1978, it converted its restaurants to Burger King locations, going private in a 1986 leveraged buyout. By 2006 it was a major BK franchisee, as well as the owner of Pollo Tropical and Taco Cabana (both acquired while private).

In 2012, Carrols spun off those brands into Fiesta Restaurant Group. (Fiesta never gained real traction; the company was acquired last month at a price below that at which it was spun off.) Three weeks later, it acquired 278 restaurants from Burger King as the company itself was returning to the public markets. That transaction was a home run for Carrols, but as the years went by its effects wore off. TAST peaked at $14 in 2018, halved by the end of 2019, and entered 2023 at $1.36 per share.

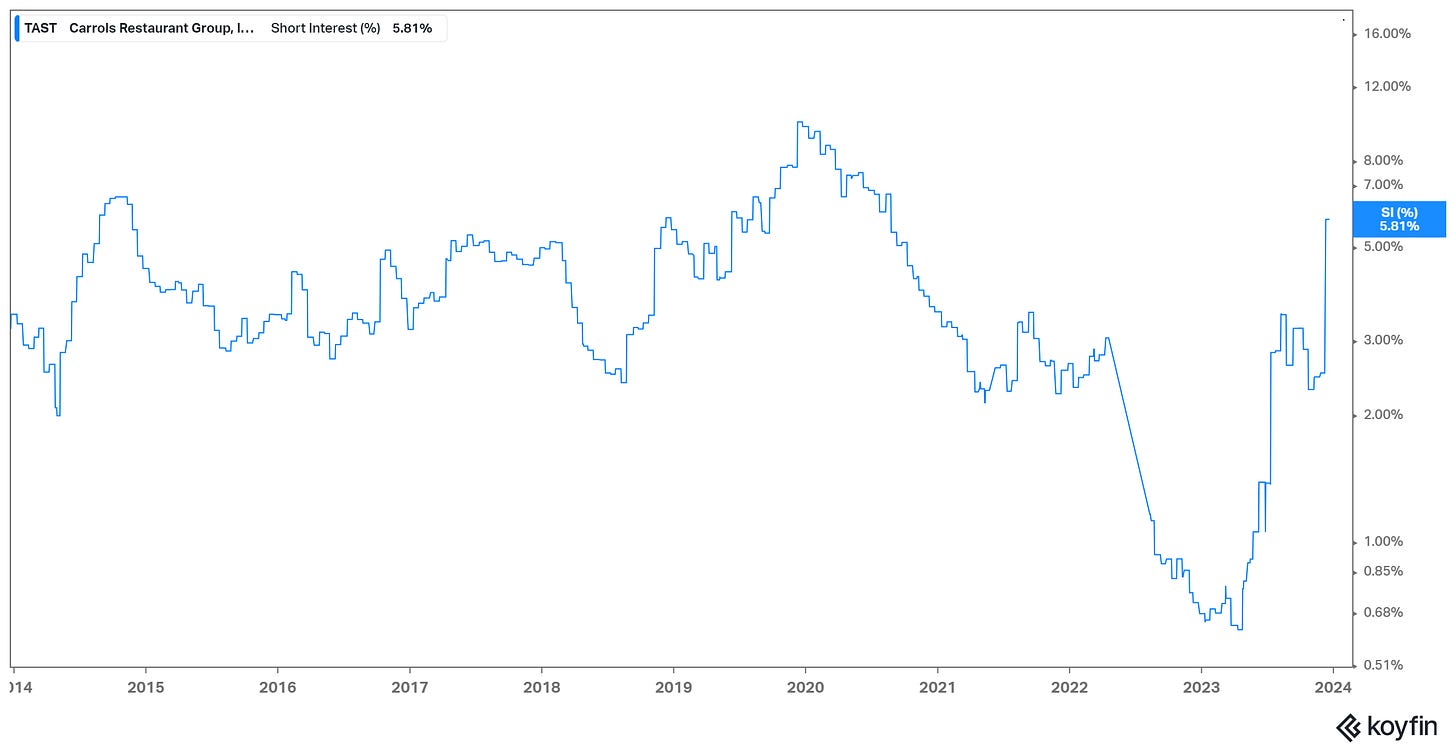

For much of that time, TAST had a decent amount of short interest, particularly for a small-cap stock with low volume and little coverage:

source: Koyfin

The reason for shorting TAST was pretty simple: there was very little evidence that the business model actually worked. Management kept acquiring franchisees, and explicitly argued that it could pay 3-4x EBITDA, while turning those acquired locations into restaurants worth 7-8x EBITDA through the sheer power of scale. But Carrols’ EBITDA margins never improved, and capital expenditures usually ate up all of that profit and then some.

Meanwhile, Carrols was a victim of aggressive discounting across fast food, and doubly exposed given its concentration in the weaker of the burger chains (even Wendy’s was showing better growth at the time). At the corporate level, Burger King (then Restaurant Brands International, after its 2014 merger with Tim Hortons) made its money off revenue; the costs were Carrols’ problem.

Yet, out of nowhere, Carrols has turned into a decent business in 2023. A 2019 merger that expanded its reach with Burger King and added chicken chain Popeyes to the mix seems to be paying dividends. Adjusted EBITDA declined 23% in 2022 to $62.5 million, notably worse than it had been seven years earlier. Guidance suggests the metric will more than double this year, to $145-$149 million, thanks mostly to increased margins.

It’s been a stunning turnaround4. I personally can’t remember being more surprised by a company changing its fortunes so quickly. There are concerns going forward: the franchisee business is still tough, EBITDA margins remain below 8%, and net debt is still almost 3x EBITDA. That means TAST can reverse again.

But as far as 2023 goes, execution has been picture-perfect. This is not a ‘hot’ sector by any means — yet TAST has more than quadrupled so far this year.

DraftKings

From early in the morning with paid programming blocks to 30-second spots during the games, ads for FanDuel and DraftKings blanketed the airwaves as the companies duke it out for a piece of the multibillion industry. In total, both companies spent a combined $31 million for roughly 9,000 national television spots last week, according to advertising tracking firm iSpot.tv.

People voiced their annoyance on Twitter, labeling them as “freaking annoying” or mocking the incessant manner they aired.

That quote comes from an article on DraftKings and FanDuel from back in 2015. At the time, daily fantasy sports was still somewhat new, and the two companies were racing to gain share of the potentially lucrative market.

Of course, it wasn’t just the DFS market they were targeting. The long-term goal was clear: for both companies to position themselves at the forefront of the legalized sports betting industry when it inevitably arrived. After all, both companies were hemorrhaging money at the same time regulatory officials around the country were cracking down on the industry. In 2018, the Supreme Court opened the door to state-by-state legalization of sports betting (and online casino), providing DraftKings the opportunity to make good on that long-term plan.

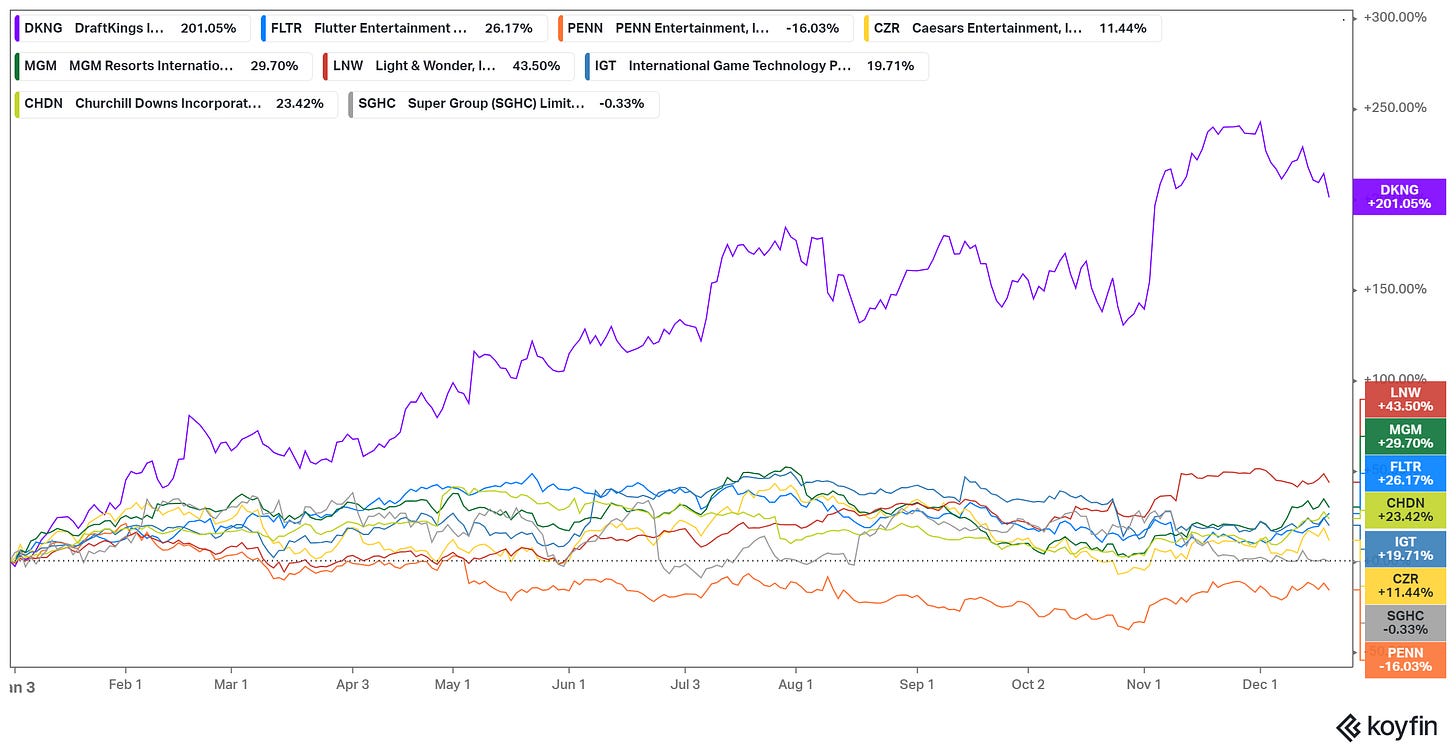

Given that opportunity, DraftKings has capitalized. DraftKings and FanDuel dominate the market, despite the seeming advantages of the loyalty programs at Caesars Entertainment and MGM Resorts International. Steadily, DraftKings has taken share, raised its estimates for the size of the addressable market, and simply out-executed pretty much every one of its rivals. The result has been spectacular outperformance against the entire sector in 2023:

source: Koyfin

There’s been some luck here. In 2021, DraftKings tried to buy Entain for about $22 billion, but was rebuffed by management. Entain’s enterprise value now is nearly half as much. Caesars, in particular, has done a terrible job of executing in the online space after years of being (without exaggeration) one of the best-led companies in the country.

And there are some concerns. DraftKings has a market cap of $16 billion yet still isn’t profitable, even on an Adjusted EBITDA basis. The company is guiding for $350 million to $450 million in profit on that basis in 2024, but this year’s stock-based comp is running above the low end of that range. From a bottom-line perspective, DraftKings still has a long way to go.

But it’s worth remembering how far DraftKings has truly come. It’s been barely a decade since the company was founded, and just eight years since it was flooding the airwaves with ‘annoying’ advertisements for a product that is now a secondary revenue stream at best. It’s dominating two of the best-known brands in the country in a market that should be lucrative for decades to come. Whatever one thinks of DraftKings going forward, that performance truly is impressive.

As of this writing, Vince Martin has no positions in any securities mentioned.

Stocks mentioned: AAPL 0.00%↑, AMZN 0.00%↑, BOX 0.00%↑, CELH 0.00%↑, CZR 0.00%↑, DKNG 0.00%↑, GOOG 0.00%↑, GOOGL 0.00%↑, JILL 0.00%↑, META 0.00%↑, MGM 0.00%↑, MSFT 0.00%↑, NVDA 0.00%↑, SLNO 0.00%↑, SMCI 0.00%↑, TAST 0.00%↑, TSLA 0.00%↑

Disclaimer: The information in this newsletter is not and should not be construed as investment advice. Overlooked Alpha is for information, entertainment purposes only. Contributors are not registered financial advisors and do not purport to tell or recommend which securities customers should buy or sell for themselves. We strive to provide accurate analysis but mistakes and errors do occur. No warranty is made to the accuracy, completeness or correctness of the information provided. The information in the publication may become outdated and there is no obligation to update any such information. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Contributors may hold or acquire securities covered in this publication, and may purchase or sell such securities at any time, including security positions that are inconsistent or contrary to positions mentioned in this publication, all without prior notice to any of the subscribers to this publication. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

We’re not including Saudi Aramco on that list. Though the company technically does have a market cap over $2 trillion, that figure is somewhat illusory.

We calculated market cap as the diluted share count in the last quarter reported in the calendar year (ie, Q3 for calendar-year companies) multiplied by year-end share count. Public data sources may use slightly different methodologies and show slightly different results.

Nvidia wound up crushing that guidance; actual revenue was $13.5 billion.

There’s a bit of a grim aspect to it as well: Carrols’ former CEO passed away unexpectedly on New Year’s Eve of last year.