This Tiny Stock Could Gain 400%

Infrastructure plays are roaring and this $100m micro cap could be next in line.

Highlights:

This marine construction and commercial concrete business has struggled for years — but new management is leading a turnaround.

Year-to-date results don’t seem to show much progress. In fact, real improvements have been made.

Valuation is already in the range of reasonable, but a substantial multi-year tailwind is arriving from U.S. federal infrastructure support.

A 35% rally in 2023 shows the market is onto the story. Risks must be understood but the stock can easily triple in a blue-sky scenario.

Back in November 2021, U.S. President Joe Biden signed the Infrastructure Investment and Jobs Act into law. 21 months later, IIJA funds are starting to be released, and the impact on earnings and stock prices is becoming apparent.

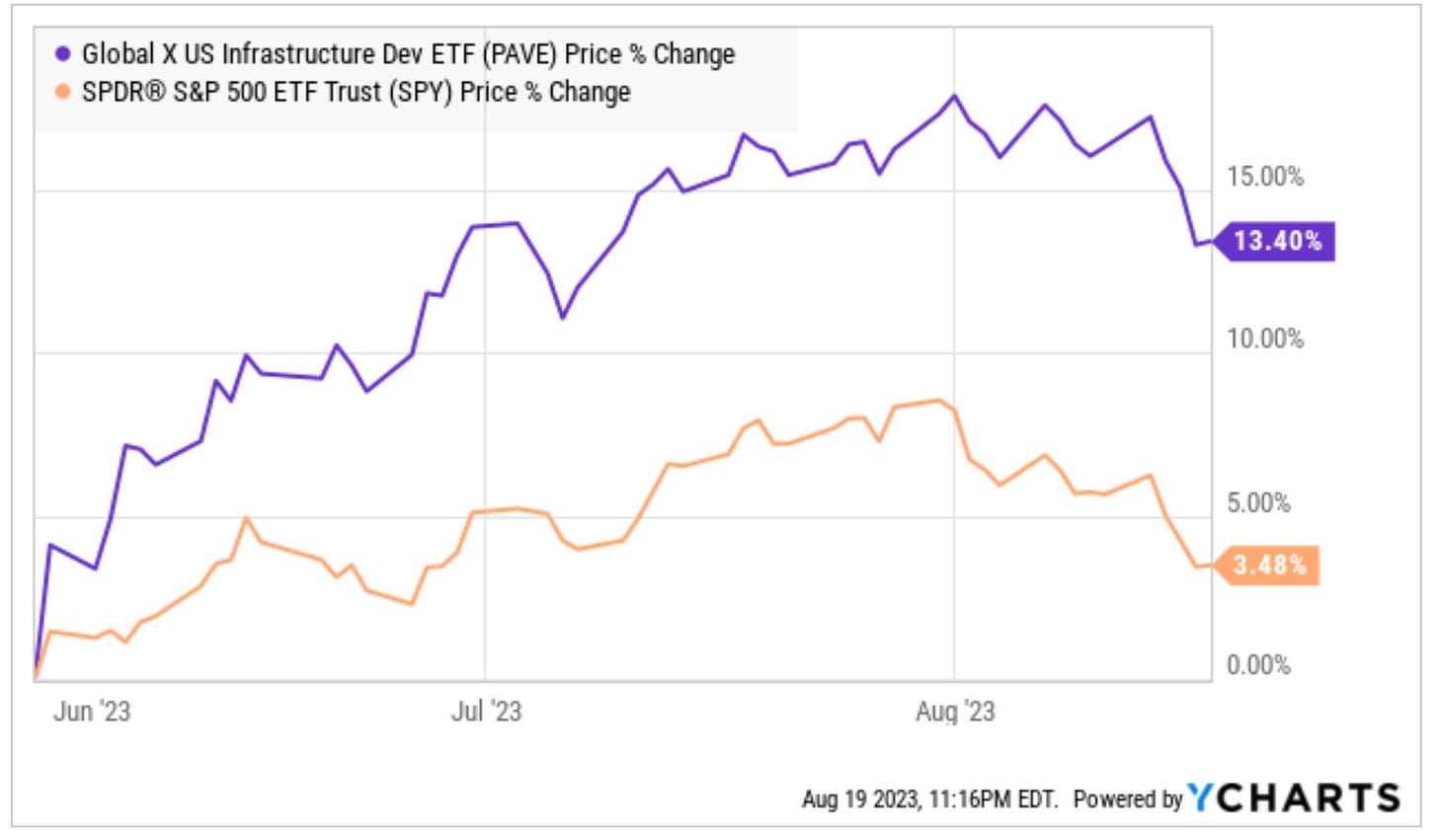

U.S. infrastructure providers posted strong second quarter earnings, and their management teams spoke optimistically about future demand driven by federal spending. As a result, since June 1 the Global X US Infrastructure Development ETF PAVE 0.00%↑ has sharply outperformed the broad market:

source: YCharts

Small-cap specialty construction play Orion Group Holdings ORN 0.00%↑ has done even better. Shares have rallied 35.5% since the beginning of June. That includes a nice rally after a well-received second quarter earnings report in late July.

But amid a shaky broad market, particularly for speculative small- and micro-caps, ORN has given back most of those post-earnings gains. With a turnaround only just beginning and a multi-year tailwind behind the company, the pullback seems like an attractive buying opportunity.

Introducing Orion Group Holdings

Orion Group Holdings was founded back in 1994 as a small marine construction project management company. Three years later, the company decided to expand beyond simple project management. Five acquisitions over the ensuing decade would turn Orion into a construction company, instead of a project manager, while also broadening the company’s geographic reach.

The strategy worked: Orion became a “single-source, turnkey solution” for marine construction, as it wrote in the registration statement for its late 2007 initial public offering. Capabilities then (and now) included port construction, dredging, bridge building and pipeline construction, along with specialty services like diving, underwater inspection, and salvage.

Despite the ugly macroeconomic backdrop caused by the financial crisis, both the business and the stock performed reasonably well. Revenue and profits continued to grow. Shares fell 35% in 2008 amid broad market selling — but more than doubled the following year.

The business then fell off a cliff in 2010 and 2011, which Orion at the time attributed to weak private market demand and more competitive bidding processes. After a modest recovery, Orion in 2015 made its biggest acquisition ever, spending $115 million to acquire TAS Commercial Concrete.

TAS moved the company into an entirely new market. It was at the time the second-largest concrete contractor in Texas, with a particular focus on the Dallas and Houston markets. TAS operates as a subcontractor in commercial projects ranging from warehouses to hospitals to office buildings to churches; the company in fact calls out that last market opportunity in its 10-K.

The following year, to reflect the acquisition, Orion changed its corporate name to Orion Group Holdings, while maintaining the name and branding in the operating subsidiaries. Eight years later, the business remains essentially the same as it was then.

Margin Problems

It’s worth noting up front that, over time, ORN hasn’t been a very good stock:

source: YCharts

The problem has not necessarily been revenue, which has increased at a steady clip. From 2005 to 2022, Orion grew revenue at an annualized rate of over 9%. To be sure, acquisitions have helped: most notably, the 2015 purchase of TAS, which created the commercial concrete business. TAS brought in a little over half of that growth.

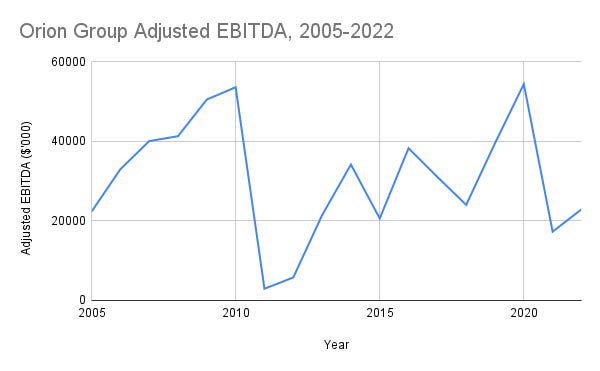

Rather, the issue has been profits:

source: author. GAAP EBITDA through 2017 (as reported by company); Adjusted EBITDA from 2018-2022 with mostly modest adjustments

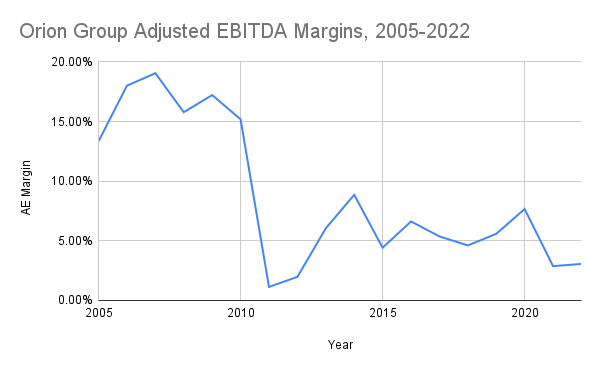

Given revenue growth, of course, the bigger problem has been profit margins:

source: author. GAAP EBITDA through 2017 (as reported by company); Adjusted EBITDA from 2018-2022 with mostly modest adjustments

The margin problem has become even worse so far in 2023: Adjusted EBITDA through the first half of the year in fact is negative, if barely so.

The Concrete Problem

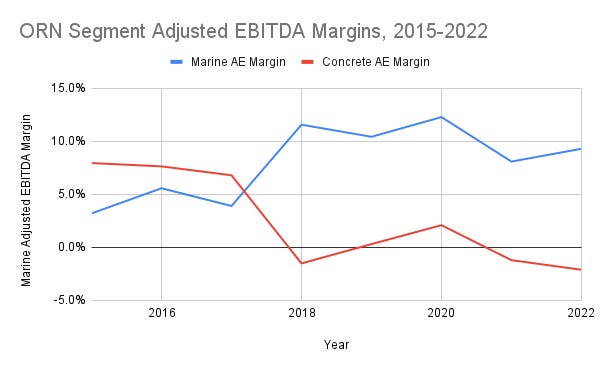

From a high-level perspective, Orion appears to be a business in decline, with an inability to create adequate returns on capital. But if you look at the segment level, the story suddenly looks quite different:

source: author from Orion press releases. Note that Orion allocates corporate expenses to individual segments, so the sum of segment Adjusted EBITDA equals total Adjusted EBITDA

TAS, the commercial concrete business, has been an enormous drag on overall results almost since it was acquired. That fact isn’t a huge surprise: Orion bought TAS from the private equity arm of investment bank Stephens, and paid under 5x 2014 EBITDA. This is not the first time that buying a business ‘cheap’ from a private equity sponsor has not worked out well.

What has happened in the concrete business is that bid margins have collapsed. Before the pandemic, former chief executive officer Mark Stauffer cited competitive pressures, as well as internal management issues. Because Orion owns nearly all of the equipment it uses for projects, the incentive for managers is to bid on contracts at low margins, with the not-entirely-unrealistic idea that modest profit is better than no profit.

But because those contracts are mostly fixed-price, the company winds up eating any cost overruns. And so bidding on projects with narrow margins (in a best-case scenario) often ends up with Orion operating projects at negative margins.

During the pandemic, the issue became even worse. A sharp pullback in construction left competitors trying to utilize their own equipment, and thus bidding low. TAS would go lower, only for labor pressures created by COVID absences and inflation to erode what narrow margins were available and then some. As a result, somewhat incredibly from 2018 to 2022 Concrete segment Adjusted EBITDA totaled negative $9 million.

In April 2022, Stauffer stepped down, no doubt with some encouragement from the board of directors. Board member Austin Shanfelter, once the chief executive officer of MasTec MTZ 0.00%↑, took over on an interim basis. Barely three weeks later, essentially the entirety of the first quarter conference call covered the challenges in the commercial concrete business. In the Q&A, one investor even asked Shanfelter why Orion didn’t just sell the business and move on.

Shanfelter’s answer — a version of his commentary throughout the call — essentially was that he believed the unit could execute better in terms of bidding, project completion, and client selection. To that end, the interim CEO instituted minimum margin requirements for bidding, and continued existing efforts to sell non-core real estate. Shanfelter also decided to de-emphasize Central Texas (Austin and San Antonio), markets which had accounted for ~20% of revenue but also provided a drag on profits and margins.

Ahead of the Q3 release, Orion brought on a new CEO, AECOM ACM 0.00%↑ veteran Travis Boone, and hired a new chief financial officer around the same time. On the Q3 call, Boone seemed to largely agree with Shanfelter’s strategy. Starting a quarter later, the strategy became much more clearly expressed.