Clearfield: Confusing Sell-Off Leaves Attractive Opportunity

It's not clear why CLFD stock has halved. Whatever the reason, the stock looks like a buy

📍 TL;DR

Over the first 11 months of 2022, CLFD was one of the best stocks in the market. Over the last 10 weeks, it’s been one of the worst.

The causes of the reversal aren’t exactly clear. The most likely culprits don’t seem material from a long-term perspective.

With the stock down more than 50% from the peak, investors can acquire a successful business with mid-term tailwinds for just 12x earnings.

On November 17th, after the market close, communications hardware provider Clearfield CLFD 0.00%↑ released earnings for the fourth quarter of fiscal 2022 (ending September). The report looked like an absolute blowout.

Revenue growth for Q4 was more than fifty percentage points better than consensus. The quarter capped off a fiscal year in which sales nearly doubled (+92%), and GAAP earnings per share soared 143%. A Needham analyst wrote that he had run out of superlatives to describe the results, and noted that his EPS estimate for FY23 was nearly double what it had been when he initiated coverage of the stock 11 months earlier.

The market as a whole seemed similarly enthused. CLFD gained 26% in regular trading the day after the Q4 release. It would tack on another 12% over the next seven sessions, touching an all-time high on November 30th.

At that point, CLFD had become one of 2022’s best stocks:

source: YCharts; chart from 12/31/21 to 11/30/22

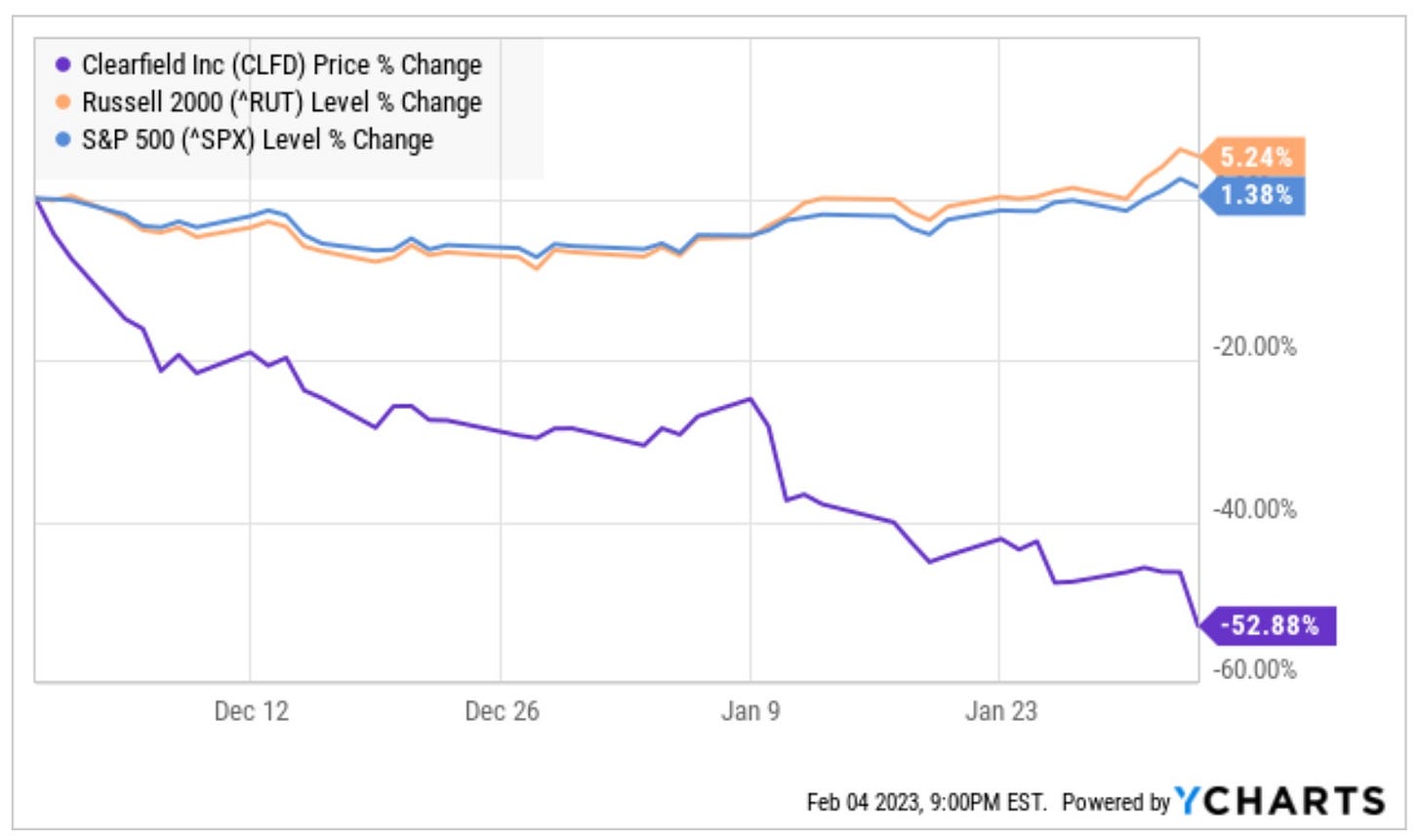

In the ten weeks since then, however, the story has completely flipped:

source: YCharts; chart since 11/30/22

So far in 2023, among nearly 3,900 stocks with a market cap of $300 million or more, CLFD is the sixth-worst performer in the entire market.

In other words, CLFD went from 99th-percentile outperformance to 99th-percentile underperformance. The obvious question is why.

There are some possible answers. But, to be honest, they’re not good enough. The story simply hasn’t changed enough to support this kind of drawdown. Admittedly, CLFD might have been overvalued at the highs, but down 50%-plus it looks easily undervalued now.

source: Clearfield corporate website

Introducing Clearfield

Clearfield provides hardware for fiber-optic deployments. The flagship product, so to speak, is the Clearfield Cassette (pictured above), a patented platform that connects and protects fiber circuits.

Using the Cassette as a base, the company offers products for the physical layer of the entire fiber ecosystem. The focus is on broadband providers, but Clearfield also serves wireless operators and traditional voice and cable suppliers as well.

The company’s products range from optical components to assemblies to deployment kits that attach to homes and businesses — all of which are then connected back through the Cassette as part of a modular solution. The July acquisition of Finland’s Nestor Cables for $23 million brought fiber-optic cable itself into the product portfolio.

Historically, Clearfield marketed almost exclusively to smaller, rural providers in the U.S., what the community refers to as “Community Broadband” customers. Those customers still account for 63% of trailing twelve-month revenue, but Clearfield has made inroads with Tier 1 and larger Tier 2 providers as well.

Clearfield was founded in 1979 as APA Enterprises. It didn’t enter the current market until the early 2000s; to that point, it had focused on high-end research relating to optical components and had developed an MOCVD (metalorganic chemical vapor disposition) system for semiconductor manufacturing. In 2007, the company sold off that business, leaving only its Cables & Networks subsidiary. At the beginning of the following year, APA collapsed its business into the subsidiary, renamed itself Clearfield, and promoted subsidiary head Cheri Beranek Podzimek to chief executive officer. She remains CEO to this day (though she has dropped the “Podzimek”).

The Long Bull Run

And here's what CLFD has done under Beranek’s stewardship:

source: YCharts; chart since 1/1/2008

At first glance, the chart here seems to suggest that all of the gains came in the last three years, but in fact at Jan. 1, 2020, CLFD had returned 1,280% under Beranek, or better than 24% annualized. Even with the recent pullback, annualized returns over the past 14-plus years clear 31%.

The stock has done exceedingly well because the business has done exceedingly well. Between FY08 and FY22, revenue rose 11.5x, a 19% compound annualized growth rate. EBITDA margins1 almost quadrupled, from 6.4% in FY08 to 24.8% last year.

As the disclaimer goes, past performance is no guarantee of future results. But it’s important in the context of the CLFD story. Over time, this has simply been a really good business.

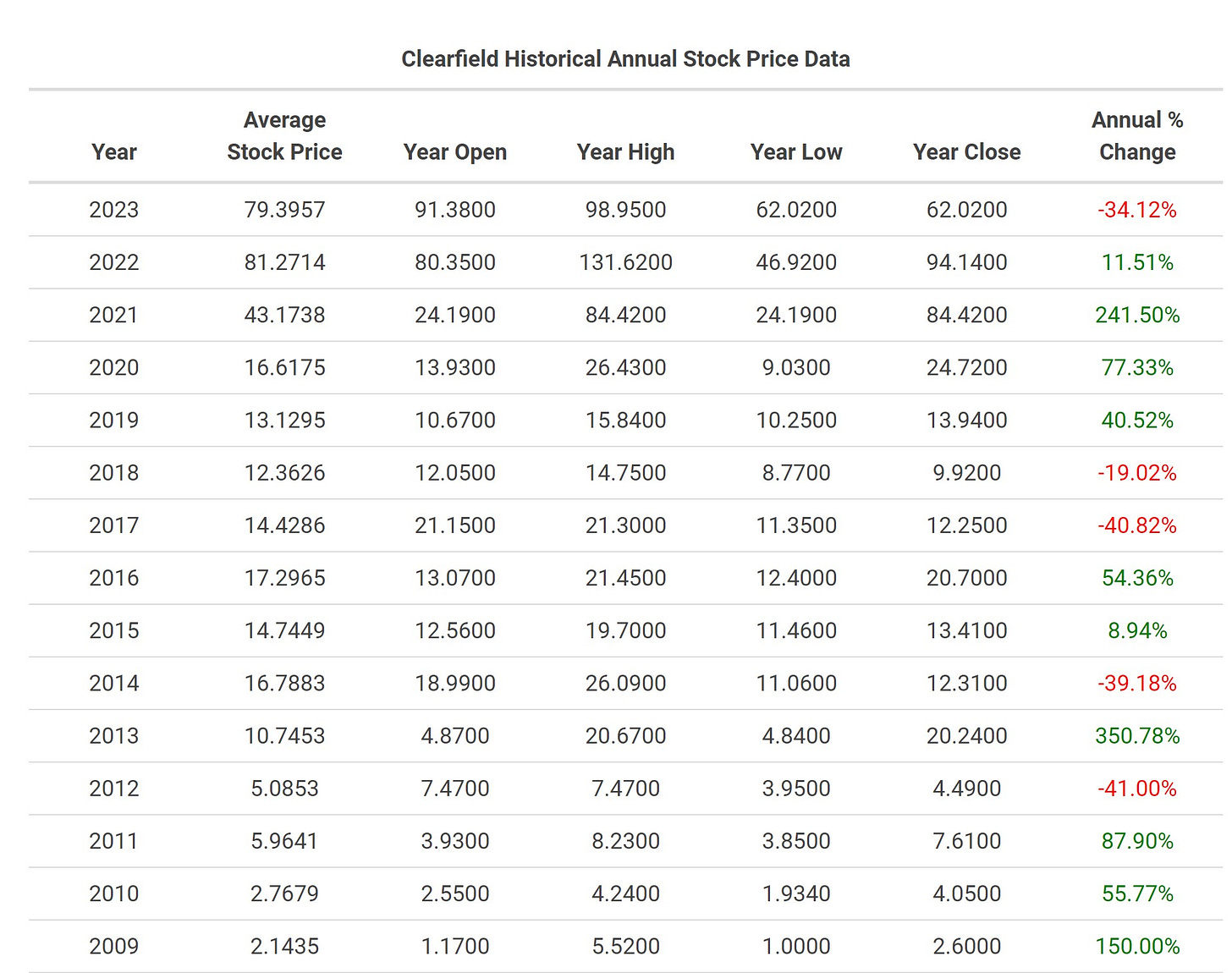

To some degree, investors might be forgetting (or ignoring) that fact. Mid-term factors played a role in the recent run to $130 in late November and no doubt have contributed to the plunge to Friday’s close of $62. But those factors have been there many, many times before. In the fourteen years in which Clearfield revenue went up 1,000%-plus, Clearfield posted single-digit top-line growth nine times (including two modest year-over-year declines).

This is a lumpy business. History shows it can be a lumpy stock, too:

source: Macrotrends

But the long-term trend is headed in the right direction. That’s an important thing to remember at the moment, as CLFD appears to be driven by shorter-term factors.

The Mid-Term Outlook

In the coming years, Clearfield’s customers — and thus Clearfield itself — will have an enormous tailwind at their back. The Infrastructure Investment and Jobs Act, signed in late 2021, includes $65 billion in subsidies for broadband deployment. The bulk of the funds are going to underserved communities — which should benefit the same providers that are Clearfield customers.

This should be good news, of course. And, as far as CLFD stock goes, until recently it was viewed as such. But, obviously, the tailwind from subsidies means that valuation based on near-term metrics should be somewhat discounted. To some degree, this is a cyclical business, and one that is headed toward a cyclical peak. Supply chain disruptions caused by the pandemic may also play a role: the combination of extended backlogs and high demand presumably led to both inventory stocking at customers (helping revenue) and a willingness to pay higher prices for that inventory (helping margins).

In fact, back in November we looked closely at a short of CLFD for precisely these reasons. At its peak, CLFD traded at ~37x FY22 earnings per share, a multiple that suggested multiple decades of continuing growth that weren’t necessarily going to materialize. At some point, the opportunity for Clearfield customers to expand into underserved areas is going to pass, and from that point the business here probably stalls out.

It’s possible that some of the decline since November has come from a gradual realization in the market of this fact. As a result, we’re not quite ready to put a $130 target on CLFD (though that in fact is where the average Street target sits at the moment). That said, the opportunity here is measured at least in years: Beranek has talked repeatedly of a “ten-year build” in this cycle. The opportunity outside the U.S. remains relatively large yet untapped: international sales accounted for just 6% of the FY22 total.

There was enough here to step away from a short at $130. Simply put, there’s plenty of growth ahead, even as backlogs normalize and market saturation eventually arrives. Of late, however, the market has disagreed.

What The Heck Happened?

On Jan. 10, CLFD dropped 4.5% on a green day for the market. The following day, it plunged 12.8%.

The culprit in both cases appears to be the Needham Growth Conference. On the 10th, Beranek appeared. The following day, Calix CALX 0.00%↑, a software company that serves the same customer base, presented.

Both presentations touched on a subject that appears to have unnerved the market: the idea that backlogs were going to normalize. Beranek noted that lead times of 12 months to 14 months had already come down to 6-8 months, and projected future normalization ahead (registration required to view video). She noted that Clearfield’s book-to-bill (ie, orders to revenue) ratio had been ~1x before the pandemic, and was headed back in that direction.

Backlog was up $99 million in FY22, about one-quarter of guided FY23 revenue. The concern seems to be that as that backlog gets worked through, revenue growth in turn will stall out. Calix chief financial officer Cory Sindelar added to those concerns the following day, talking about the impact of supply chains (again, registration required) on margins and noting that “backlogs are going to normalize and that’s going to make it scary for management teams”.

Sindelar’s appearance seems to have taken his own stock down as well. But as far as CLFD goes, it’s not clear why the commentary so spooked investors. It’s worth noting that Beranek said precisely the same thing on the fourth quarter conference call, and CLFD went up 26% the next day. One CALX analyst argued last month that investors “conflated overall industry shrinking book-to-bill and backlog metrics with a weaking demand environment”, and to our eye that seems a correct interpretation of the sell-off in CLFD as well.

These conference appearances certainly are not the only factor in the decline in CLFD. CALX is down 23% year-to-date, and in fact is the second worst mid-cap or larger stock in the market. (Only MSP Recovery LIFW 0.00%↑ has done worse, and that's because it's a crazy de-SPAC that sold a tiny sliver of its equity in the merger.) Meanwhile, after a brutal 2022, cable stocks are outperforming nicely here in 2023.

Those cable stocks were hammered last year in part by fears of fiber competition and thus pricing pressure. Charter Communications CHTR 0.00%↑ dropped 48% in 2022 and Cable One CABO 0.00%↑ 60%. Already in 2023, they're up 20% and 16%, respectively. In selling CALX and CLFD, and buying CHTR and CABO, the market is acting as if fiber overbuilding, as it’s known, is not going to be quite as massive as believed just a couple of months ago. It’s possible there’s some truth to that judgment, particularly with most overbuilders badly missing targets in recent years and now facing sharply higher costs of capital.

In addition, Clearfield itself has contributed to the sell-off. A secondary offering in December was priced at $100; shares fell 6% on the announcement. Fiscal Q1 earnings on Thursday afternoon led to another decline, of 12% on Friday.

Taken as a whole, then, the 50%-plus decline does make some sense. CFLD ran too far in November, to the point where it looked much more like a short than a long. Sentiment toward the industry it serves has changed. Shareholders were diluted, and then earnings disappointed. That story might suggest $62 is a little too cheap, depending on an investor’s viewpoint, but hardly a table-thumping opportunity.

Taking A Step Back

We’d argue otherwise, however. To our eye, this is a hugely attractive opportunity. And the market’s reasons for creating the opportunity look rather thin.

Whatever the market’s interpretation of the Needham presentations, they simply don’t matter all that much in the long-term. We know the mid-term opportunity here is huge. Government subsidies are on the way2, and underserved communities are numerous. (My wife and I in 2021 planned to move to a small coastal town, until we realized ridiculously late into the process that the town, with a population of roughly 10,000, did not have sufficient broadband speed except in one single development.) FY23 or FY25 revenue growth rates matter, but at this valuation (more in a moment) they don’t make or break the long case.

The same is true regarding the pace of overbuilding. Clearfield has moved up to larger customers, including Cable One, Frontier Communications FYBR 0.00%↑, and Windstream Holdings, but it's still not that exposed to overbuilding as a growth driver. Its bread-and-butter is in community broadband, which are smaller monopoly operators who, again, are going to build out their networks regardless (and with government help).

At $62, meanwhile, the secondary offering is good news. A CEO who has led her company’s stock to rise 60-fold decided her company needed more cash to fund growth, and raised that cash at a 50%-plus premium to the current stock price. One worry might be that Clearfield is going to splurge on an acquisition, but this isn’t an acquisitive company (Nestor was the first acquisition of an operating business3 in Clearfield’s history) nor is there a logical target. Most competitors are divisions of much larger companies. Rather, after Clearfield spent essentially all of its free cash flow in FY22 on inventory (a build of $44 million, and FCF of negative $8 million), the company needed breathing room.

As for the reaction to Q1 earnings, honestly…we’re stumped. The report was fine. Earnings per share guidance for FY23 of $4.30-$4.50 perfectly bracketed Street consensus of $4.40. It’s possible that investors were hoping for more, after the company crushed its original outlook last year. But Beranek (at the Needham conference) alluded that investors were wrong to believe the company was “sandbagging” guidance based on its backlog. It’s possible that comment contributed to the weakness in CLFD in January. But it doesn’t make sense that unmet expectations for a guidance hike would hurt the stock again in February.

It’s also possible that a key driver here is simply equity market forces. The selling into and out of year-end could be driven by tax considerations. YTD performance could be exaggerated by positioning. This chart highlights CALX, but the overlay works equally well for CLFD:

Valuation and the Bull Case

Whatever the causes — and clearly, there are several — CLFD after earnings looks like a hugely attractive opportunity from the long side. Fully-diluted market cap here looks to be about $950 million4. Net cash at the end of Q1 was about $152 million, or ~$10 per share.

At the midpoint of FY23 EPS guidance, CLFD is trading at just over 14x earnings. Ex-cash, the multiple drops below 12x. Peer comparisons aren’t great here, but we can understand relatively easily what this valuation suggests: that FY23 results are mid-cycle earnings.

That seems an exceptionally conservative view. Again, Clearfield is facing a multi-year ramp thanks to the subsidized rollout of fiber across the U.S. It’s expanded capacity dramatically, both in its home state of Minnesota and at a facility in Mexico (which will also manufacture fiber-optic cable designed by Nestor). The international opportunity is largely untapped.

One possible source of concern would be margins, which expanded tremendously after the pandemic arrived. EBITDA margins were 8.7% in FY19 against 24.8% in FY20. But FY23 guidance assumes some EBITDA margin compression — including the impact of capacity expansion on gross margin — and nearly all of the post-FY19 expansion has come from operating leverage, rather than higher pricing. Gross margins of 41.7% in FY22 were exactly in line with the seven-year average from FY11 through FY17 (before Clearfield suffered through a couple of disappointing years, driven in part by investments behind the business).

In that context, there’s not necessarily a massive reversion to the mean ahead. The risk that supply chain disruption led Clearfield to overearn seems somewhat belied both by the fundamentals and by management commentary. (Beranek has emphasized that the company took the long view during those disruptions, aiming to take market share longer-term rather than simply garnering every possible dollar of pricing.)

Near-term, there are clearly “falling knife” concerns. But this business still looks to be in fine shape. There’s no sign that Clearfield’s competitive positioning has weakened. The business is on track to 16x revenue in 15 years, and as Beranek noted at Needham, the industry’s association estimated its market grew ~15% in 2022, while Clearfield grew revenue 90%.

The mid-term tailwinds are all intact. Fixed wireless has long been touted as a threat to fiber deployments, but it’s unlikely to work in rural communities, has potential interference issues in homes and businesses, may not handle rising bandwidth needs, and actually requires its own fiber (as noted, Clearfield serves wireless customers as well).

And the valuation at this point is exceptionally conservative. A business guiding for low-40s revenue growth this year (~30% organic), on top of a 90% increase in FY22, is trading at ~12x earnings excluding cash on the balance sheet.

That’s simply too low. Admittedly, it’s difficult to pinpoint precisely what the correct multiple is. Direct peers don’t exist on the public markets. Few hardware providers have a similar multi-year growth opportunity.

But we’d note that CALX, after a sell-off of its own, trades at ~3.5x CY23 consensus revenue estimates. Its target model suggests double-digit operating margins on a non-GAAP basis (ie, excluding stock-based comp, which is running at ~5% of sales). Clearfield is already well ahead of that margin bogey — and trades at barely 2x FY23 revenue guidance.

Bump that multiple up a turn (still shy of CALX) and CLFD moves to ~$85 or so, roughly 40% upside. A high-teens P/E multiple (suggesting some growth off the FY23 base, if not the torrid results of late) gets in the same ballpark.

Whatever the precise model (and, again, the Street is at $130), $62 is a valuation that suggests that trouble is on the way. Yet there’s little sign of that trouble anywhere.

At some point, trouble will arrive. It happened in the mid-2010s. Beranek herself said at Needham that “this is a ten-year build, there might be a couple of lumps.”

But, for 15 years, whenever the market has sold off CLFD based on a single quarter or even a single year, it’s created an attractive long-term opportunity in the process. We’re skeptical this time is any different.

As of this writing, Vince Martin has no positions in any securities mentioned. He may initiate a long position in CLFD this week.

If you enjoyed this post you can help us by clicking the heart ❤️

Disclaimer: The information in this newsletter is not and should not be construed as investment advice. Overlooked Alpha is for information, entertainment purposes only. Contributors are not registered financial advisors and do not purport to tell or recommend which securities customers should buy or sell for themselves. We strive to provide accurate analysis but mistakes and errors do occur. No warranty is made to the accuracy, completeness or correctness of the information provided. The information in the publication may become outdated and there is no obligation to update any such information. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Contributors may hold or acquire securities covered in this publication, and may purchase or sell such securities at any time, including security positions that are inconsistent or contrary to positions mentioned in this publication, all without prior notice to any of the subscribers to this publication. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

EBITDA margins mentioned here are author’s calculations, with minimal adjustments for non-cash factors, but no exclusion of stock-based comp.

One could argue that, should the GOP control White House and Congress in 2025, they would want to cut spending. But history shows, no matter their claims, that party does not cut spending, and if they did, it’s hard to see them reducing subsidies that largely serve more rural and thus more Republican-leaning areas.

It has added product lines, including a 2018 deal with Calix to acquire outdoor cabinets.

The secondary offering occurred toward the end of Q1, and the 10-Q hasn’t been filed, so we’re adding the share count from the 10-K plus the 1.38 million shares sold in the secondary to get to ~15.2 million.

Momentum buyers and secondary investors trapped in a broken chart now turned sellers?

Get me out lol.