With earnings season past its peak, we thought we’d take the opportunity to provide updates on some of our picks and our performance in general.

Our Performance So Far

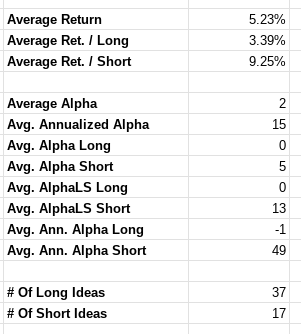

13-plus months into this project, our performance is good, but not quite as good as we would like. At Wednesday’s close, our average idea has returned 5.2%. Meanwhile the S&P 500 has dropped 8.1%. Our average alpha against the S&P 500 Total Return is just shy of 150 basis points.

On an annualized basis, performance looks better. On average, alpha has been a healthy 15 percentage points. That figure is skewed by more recent articles but looking just to the 2022 cohort, annualized alpha is just shy of 20 percentage points.

We can say with some confidence that, to this point, we’ve done a solid job of providing better-than-average ideas. That’s even more true given that a better comparison for our universe might be the Russell 2000, which has underperformed sharply in recent months.1

That said, it’s been our short ideas that have carried most of the water. Long performance is basically flat to the S&P, and we’ve unfortunately stumbled into a few value traps. Our shorts, however, have been excellent. Average alpha of five percentage points, 13 points against the inverse of the S&P 500, and 49 points on an annualized basis.

Overall, given that we provide ideas on a weekly basis we do take pride in how our ideas have performed to this point. We hope, and plan, to do even better.

[Note: You can view our performance spreadsheet for a full breakdown of our results]

NeoGames: A Nice Win

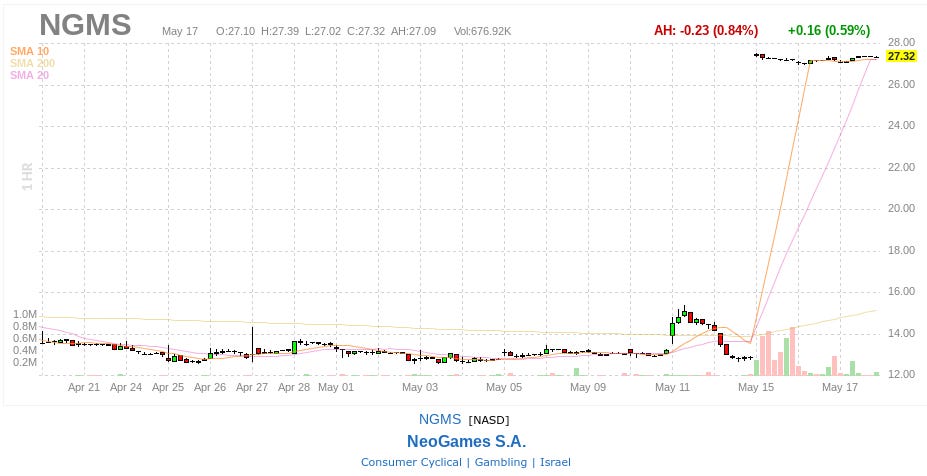

Our second article ever, a long pitch for iGaming play NeoGames NGMS 0.00%↑, is now our best-performing idea so far. On Sunday, the company disclosed that it was being acquired by Australia’s Aristocrat Leisure for a $29.50/share all-cash offer. The stock closed Wednesday at $27.32, up 106% from where we recommended it.

source: Finviz.com

We see the offer from Aristocrat as validating our thesis. We believed that, owing to revenue recognition around a joint venture, the market didn’t fully understand how quickly the company was growing. The 104% premium over the 3-month volume weighted average price for NGMS shows that Aristocrat (one of the best-managed and best-performing companies in the slot manufacturing industry) does understand.

Wednesday’s close suggests an 8% return for investors willing to hold until completion. That premium seems directionally correct. Majority shareholders in NeoGames have already committed to approve the sale. Regulatory intervention seems unlikely.

But those regulators will take time: NeoGames expects the deal to close “within 12 months”. With the 12-month Treasury yielding almost 5%, this is a trade for merger arbs rather than value investors. I’ve exited my position, and we’ll take the opportunity to close the position in our spreadsheet. We still see the potential for success for NeoGames under Aristocrat’s ownership. As we noted on Twitter, we think Aristocrat stock looks intriguing going forward as well.

AppLovin: Grinding Back Up

Our second idea ever is our best-performing idea. And our first idea is no longer our worst-performing idea.

It’s hardly cause for celebration but AppLovin APP 0.00%↑ is showing signs of life. Thanks in part to successive earnings beats, APP has gained 131% year-to-date. The only larger company (of more than 800) with better YTD performance is warehouse automation play Symbotic SYM 0.00%↑.

I personally rode APP all the way down (as we say, we do eat our own cooking). The aborted effort to acquire rival Unity Software U 0.00%↑ was a concern (and a major misstep), but even with disappointing 2022 results, there still seemed to be a case for upside at each successively lower price.

We’re starting to see that case play out. AppLovin has successfully restructured its Apps business (ie, its owned game portfolio) to improve margins, bringing in some cash through asset sales in the process. Meanwhile, the Software Platform segment, is performing well, with growth of 16% q/q and 8% y/y in Q1. It seems like both AppLovin and its customers are adjusting to the privacy changes enacted by Apple AAPL 0.00%↑.

If that’s the case, there’s still a pretty solid bull case here. AppLovin is clearly outperforming Unity, and clearly is a huge part of the mobile gaming ecosystem. Valuation is not that prohibitive: APP trades at about 11x trailing twelve-month Adjusted EBITDA. That multiple admittedly is deflated by two factors: stock-based comp (~19% of the total) and the contribution from the less-valuable Apps segment (~25%), where revenue is declining.

But even accounting for both those factors, APP is trading for 18-19x EBITDA, and thus ~30x free cash flow. That’s despite strong success in the gaming ecosystem, room for expansion beyond, and continued benefits as the advertising industry adapts to the ‘new normal’. Meanwhile, the Apps business has *some* value, easily 10% of enterprise value even at 4x EBITDA.

It’s still a long way to breakeven, and at this point I’m personally not looking to average down. Still, there’s a reason why APP has been a big winner so far this year. The bull case we made last year has merit, even if the price I paid did not.

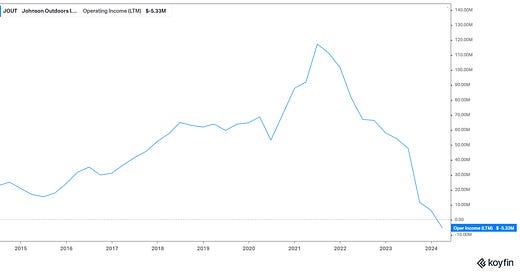

Coherent: A Disappointing Quarter

We pitched COHR a month ago in part because the stock had declined due to two pieces of external news that we didn’t see as particularly material to the long-term case.

One of those developments was a profit warning in early April from rival Lumentum LITE 0.00%↑. But Coherent seems to have taken some market share from Lumentum. That suggests Lumentum wasn’t signaling industry weakness, but simply its own specific troubles with key customer Ciena CIEN 0.00%↑, which had delayed taking shipments. And so we wrote that last week’s fiscal Q3 report could represent an upside catalyst [emphasis in original]:

That said, Ciena itself came out and reaffirmed guidance for the coming quarter and the full fiscal year (ending October). That company also posted an exceptionally strong FQ1 which sent its stock higher. More importantly, Coherent itself hasn’t issued a warning two-plus weeks after the end of its FQ3. Perhaps sector weakness will arrive a bit later, but management would be playing an exceptionally dangerous game to not warn on a soft quarter after the Lumentum pre-announcement.

We added later that “a strong report from Coherent establishes an important contrast with Lumentum,” potentially leading COHR to re-rate to a multiple above its peer, rather than in-line with it.

That is not what happened. Perhaps, as with MediaAlpha, the market was correctly pricing in weak results ahead of time. Coherent’s adjusted earnings per share of $0.58 missed consensus by $0.24. FQ4 guidance was much worse: the high end of revenue more than 10% below the Street and non-GAAP EPS of $0.33-$0.43 against expectations of $0.86. Notably, Coherent blamed its weakness on the same factor as Lumentum: the delay of scheduled shipments by major customers, toward the back half of the quarter.

That said, the long-term case still holds. At ~10x FY23 adjusted EPS, COHR is being valued as a networking play. But there are real growth areas here in silicon carbide, OLED displays, and data center architectures.

The one concern after Q3 and ahead of Q4 is whether investors need to buy now. Coherent is front-loading capex behind its silicon carbide efforts, which will pressure free cash flow. Also, demand weakness in networking may last for more than a quarter and a half. Still, we’re optimistic toward the long-term case, even if the short-term thesis didn’t play out.

MediaAlpha: The Market Was Right

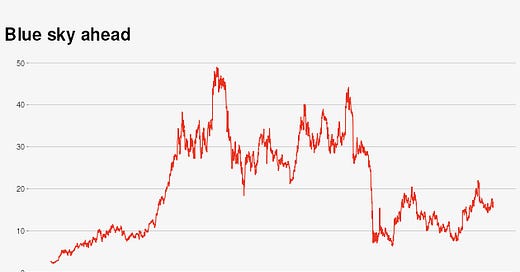

We’ll return briefly to our short call on MediaAlpha simply because the performance of MAX stock has been fascinating. As we noted last month, the stock and the broader insurance lead generation2 group plunged sharply almost out of nowhere.

The steepness of the decline — MAX dropped 40% in twelve trading sessions — was stunning, particularly given that the catalyst appeared to be only a soft earnings report from Progressive PGR 0.00%↑, a key MediaAlpha customer.

In April, we argued that shorts could likely cover, and for two days the stock found a bottom. MAX promptly dropped 40% once again, this time in just eight trading sessions, and again with absolutely no news from the company itself:

As it turned out, the market knew what it was doing. The case for MAX at the start of the year was that a so-called “hard market” for the likes of Progressive and GEICO would end, allowing those companies to get back to marketing spend. But in its Q1 report on May 4, MediaAlpha said that its largest customer3 had pulled back sharply on its spending.

Q2 guidance (revenue down more than 20% year-over-year, Adjusted EBITDA margins of ~2%) looked ugly — but MAX actually gained 2% the following day. Further declines would follow; MAX hit an all-time low on Tuesday before rocketing 16% on Wednesday (that gain, too, doesn’t have an obvious catalyst).

We don’t see these lower levels as close to a buying opportunity. MAX still trades at more than 8x the high point of 2021 EBITDA guidance, a year that was exceptionally favorable toward the likes of Progressive and a year that represented something like a cyclical peak.

There’s an interesting lesson here for investors like myself. In the days before MAX crashed there was an assumption that something must be happening in the market. Somebody blew up and got a margin call or a major shareholder was selling their stake.

Increasingly, though, when stocks dive like this with no apparent catalyst — the initial assumption should be that something is happening in the business. It’s just that the ‘something’ isn’t necessarily apparent to the rest of us yet.

As of this writing, Vince Martin is long APP.

Disclaimer: The information in this newsletter is not and should not be construed as investment advice. Overlooked Alpha is for information, entertainment purposes only. Contributors are not registered financial advisors and do not purport to tell or recommend which securities customers should buy or sell for themselves. We strive to provide accurate analysis but mistakes and errors do occur. No warranty is made to the accuracy, completeness or correctness of the information provided. The information in the publication may become outdated and there is no obligation to update any such information. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Contributors may hold or acquire securities covered in this publication, and may purchase or sell such securities at any time, including security positions that are inconsistent or contrary to positions mentioned in this publication, all without prior notice to any of the subscribers to this publication. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

Somewhat quietly, the Russell 2000 Total Return is -10.2% over the past three months, while the S&P 500 Total Return is +2.1%. The banking crisis no doubt is a significant factor.

That’s not precisely what MediaAlpha claims that it does, but it’s basically what it actually does.

We believe this is Progressive; it’s possible it’s GEICO. Those two companies are the two biggest customers, but each has had significant variability in recent spend, per MediaAlpha commentary.

Keep the ideas coming, I'm enjoying your research.

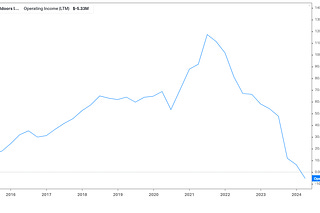

Your analysis on MAX above reminds me of $TDOC.. they had some nice run up around Q1 earnings but all the gains have been wiped out since and heading to a lower price level as we speak.

Does this also infer that something is not working within the business? TDOC has been notorious for their aggresive spending in sales and marketing even faster than the growth in revenue, implying that (1) they have negative operating leverage, and (2) they could face growth decline if they stop the ads and marketing.