4 Stocks Facing A Big 2024

We look at four names facing a pivotal year ahead.

(Author’s note: This is the final installment of our year-end coverage. We return to our normal schedule this weekend, with a deep dive on Sunday, January 7.)

We spent last week looking back at 2023. This week, we take a look forward, focusing on four stocks that have a huge year ahead. For each of these names, there are paths ahead which could mean very different things for the share price.

PayPal Needs Growth

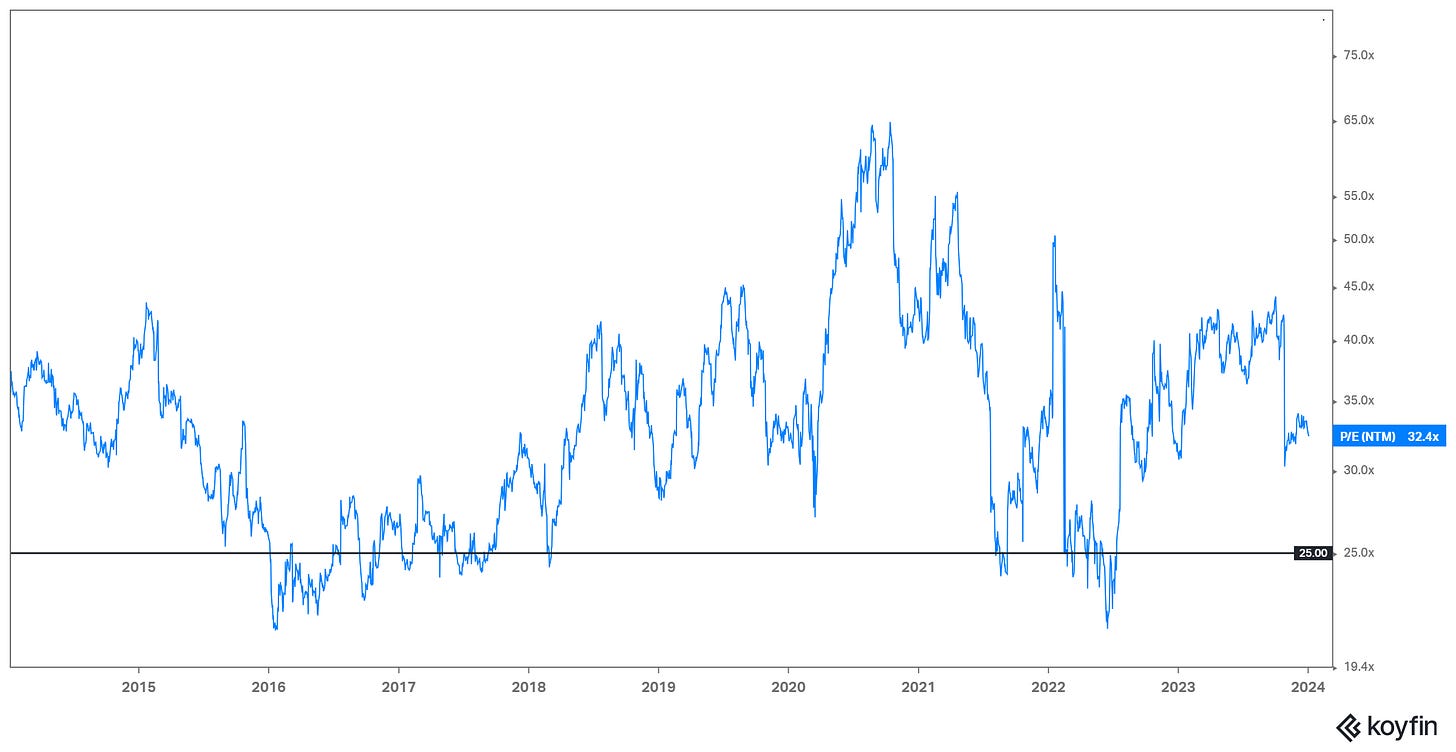

This chart just about says it all:

source: Koyfin

In less than two years, PayPal PYPL 0.00%↑ went from a growth stock to a value stock. Shares are down 80% from their 2021 peak. All of that comes from multiple compression. Analysts actually expect adjusted earnings per share to be ~8% higher in 2023 than it was two years earlier (though most of that growth comes from stock buybacks).

Yet shares now trade at barely 11x estimated earnings for the next four quarters — and right at 10x when backing out $9 billion (almost $8 per share) in cash net of debt. In other words, the market expects PayPal performance will get worse.

There are plenty of reasons for concern. Competition in payments is leading to worries about a “race to zero” in pricing, particularly in the ‘unbranded’ side of the industry (where PayPal competes with its Braintree business). The sector saw a couple of huge sell-offs in 2023: Adyen stock fell 63% into and out of August earnings, and France’s Worldine plunged 59% after its Q3 report in October.

So after flooding into the payments industry during 2020-2021, amid projections of accelerated long-term growth in e-commerce spending, investors now appear skeptical of the sector. PYPL is the epitome of that change in sentiment.

PayPal certainly has a chance to re-instill confidence. A new chief executive officer and a new chief financial officer have arrived within the last few months. Q3 earnings were better than expected, perhaps raising hopes that PayPal can drive both revenue growth and improved profit margins. Shares are now up 22% from late October levels (which, somewhat incredibly, were a six-year low).

But PayPal needs to deliver in 2024. It needs to prove its business is not being commoditized, and that there’s enough low-hanging fruit for new leadership to materially change the company’s profitability. That should be enough to reverse the trend of steady multiple compression, and the combination of EPS growth and a higher multiple means 30%-plus upside is absolutely on the table this year. It’s worth noting that both Adyen and Worldline have roared from their lows. A solid year of growth opens the same path for PYPL.

Anything less, however, and the perception of PayPal as a competitively challenged, low-growth business becomes entrenched. That is an exceptionally difficult perception to escape from.

Ambarella: An AI Winner Or Not?

In May of last year, the blowout first quarter report from Nvidia NVDA 0.00%↑ set off a massive rally in semiconductor stocks. Ambarella AMBA 0.00%↑, a developer of video and image processing chips that is adding artificial intelligence products, joined the fun. Starting in late April, AMBA gained 45% in seven weeks, even powering through a disappointing fiscal Q1 report in late May that sent the stock down 12%.

Those gains are completely gone. AMBA faded into the end of the year, and in fact finished the year down 25%. That’s remarkable underperformance against the sector as a whole. For the year, the Philadelphia Semiconductor Index gained 61%:

source: Koyfin

The decline in AMBA makes some sense when looking at the company’s results for the year. At the midpoint of guidance, revenue in fiscal 2024 (ending January) will decline 33% year-over-year. The comparison wasn’t exactly difficult, either: revenue rose less than 2% in FY23.

To listen to management, the problem is purely cyclical. Ambarella is blaming inventory reductions at customers, along with weak end markets. These are the same explanations usually heard in the chip space and other industries in the volatile post-pandemic period.

Meanwhile, management sees better days ahead. The rise of AI will allow the company to shift from standard video processing chips to full SoCs (system-on-chips) and software that can support AI-driven ‘machine sensing’ — the ability to recognize and make decisions based on images and video. Combined with new product launches and a cyclical upswing (management expects revenue growth to return in FY25), the AI wave creates an opportunity for strong growth going forward.

It’s a tempting story — but it needs to be. In the context of current fundamentals, AMBA seems wildly overvalued. Based on Q4 guidance, the stock trades at about 10x on an EV/revenue basis, and even adjusted profitability is nowhere in sight. Even with the 2023 decline, AMBA is still pricing in a business that at some point roars back.

And so calendar 2024 results look extremely important for the long-term story. Ambarella needs to prove that FY24 weakness really was about cyclicality, and not market share loss. It needs to justify its description as “an edge AI semiconductor company”, and show that newer chips and a move into LLMs (large language models) doesn’t simply cannibalize legacy products, leaving little change in a historically cyclical and volatile business.

If Ambarella can do that, the opportunity for upside is enormous. This is a stock that can move in a hurry when sentiment changes:

And if that sentiment turns from “what is going on here?” to “Ambarella is a potential leader in edge AI”, the fundamentals won’t be the focus. The story will. After a 2023 full of AI winners, Ambarella has a clear opportunity to join that group in 2024 — if it can deliver on its potential.

Owens & Minor Goes For A Ride

For years, Owens & Minor OMI 0.00%↑ looked like a solid, if sleepy, business — the kind often recommended by advisors who favor defensive dividend payers with a long-term focus. Those advisors would have done well by their clients: OMI nicely outperformed the market for several decades.

But by 2016, the business was showing some weakness. Already-thin margins (adjusted operating income was just 2.31% of revenue in 2016) were starting to crack. Shorts took aim, and even O&M management saw danger ahead. So the company spent over $1 billion acquiring a medical supplies manufacturer and a direct-to-patient distributor, in part to lessen its reliance on the struggling legacy business.

That strategy didn’t work. The spending added more leverage to an already-indebted company, forcing O&M to nearly eliminate its dividend. Margins and profits headed south. By 2019, O&M stock was below $3, and with net debt at 7x EBITDA faced a legitimate chance of a restructuring.

The novel coronavirus pandemic, however, rescued the company. One of the businesses O&M had acquired was the surgical and infection prevention business of Halyard Health. Halyard’s gloves, gowns and respirators suddenly saw soaring demand. In two years, operating profit in the Global Products segment (built mostly around Halyard) rose 471%; operating margins went from 4.5% to 14%.

The sudden growth allowed O&M to pay down debt, and sharply lower its net debt-to-EBITDA ratio to under 2x. OMI stock unsurprisingly soared. At its June 2021 peak, the stock had rallied over 1,800% in less than two years, making it one of the best stocks in an exceptionally bullish market.

But normalization of life after the pandemic suggested normalization of product margins — and lower earnings as a result. After the Q4 2021 report, O&M guided for a full-year decline in revenue and profits for 2022. And to combat that reversal, O&M made another acquisition, paying $1.45 billion for Apria, a provider of home health equipment with a focus on respiratory therapy and sleep apnea treatment (each 41% of revenue in 2020).

As with so many other ‘pandemic winners’, however, normalization proved much more painful than investors and executives had realized. O&M badly missed on its 2022 guidance, which combined with the cost of the Apria transaction brought debt concerns back to the fore. By the end of 2022, O&M’s leverage once again was well past 4x. 2023 showed more volatility and the stock fell 1.3% for the full year.

The result has been ironic. After decades of consistent outperformance and below-market volatility, OMI has become an epic roller coaster with trading driven by the external environment:

source: Koyfin; chart since 12/31/1999

Where Does OMI Go From Here?

There’s certainly a way to see OMI as an opportunity in 2024 and beyond. Valuation has come back in: based on full-year 2023 guidance, shares trade at 6.2x Adjusted EBITDA and a little over 14x earnings per share. Meanwhile, post-Apria, this is now largely a home health play: what O&M now calls its Patient Direct business accounts for ~80% of consolidated EBITDA. And as we noted in September, there’s been an aggressive effort by payors (commercial and government) to elevate home health, while major insurers have spent billions to enter that market.

At its Investor Day last month, O&M management offered a strong multi-year outlook. The company sees 2028 adjusted EPS around $3.50, up from ~$1.35 in 2023. With Adjusted EBITDA projected above $750 million, and O&M planning on reducing net leverage to 2x-3x EBITDA, even with no multiple expansion OMI should at least double in five years if those targets are hit.

But as the past seven years show, that is a huge ‘if’. That’s all the more true given that the Investor Day didn’t exactly offer the most defined roadmap to upside. O&M plans to win in home health and improve the legacy distribution and product businesses. Aside from plans to ramp product launches, there wasn’t a ton of new information offered. The strategy mostly boils down to “do home health well and do the rest of the business better”.1 And though it wasn’t the intent, this slide from the presentation seems to capture that broader message:

source: Owens & Minor Investor Day presentation

There’s a path to earnings and share price upside over the next five years, but it’s hardly obvious what that path is.

Meanwhile, the external environment might not be done affecting the O&M business. In Patient Direct, there’s one clear mid- to long-term risk:

source: Owens & Minor Investor Day presentation (author highlighting)

Over half of Patient Direct revenue — so ~40% of consolidated EBITDA — comes from two end markets potentially at risk from Ozempic and other GLP-1 agonists. Pretty much every stock with diabetes exposure sold off in 2023, and sleep apnea players didn’t do much better2.

In that context, OMI’s nearly flat performance in 2023 actually looks quite positive. But the potential impacts of GLP-1s further add importance to the results from the business in 2024. There’s absolutely a scenario in which further post-pandemic normalization, execution issues, and/or end market weakness combine with leverage to send OMI plunging. It’s up to the business to match the optimism delivered last month and prevent that outcome.

Boston Beer: When Does The Market Run Out Of Patience?

It’s important to remember one key aspect of the Boston Beer SAM 0.00%↑ business model. Incremental margins in the business are quite high: it does not cost that much to brew, bottle, package, and ship an extra case or barrel of beer. Margins thus are driven by capacity utilization. As utilization increases, profit growth can significantly outpace revenue growth.

And so for years now, investors have been willing to pay up for the stock. Even disregarding its 2021 peak (driven by a brief explosion in demand for hard seltzer) the multiples assigned to SAM have consistently appeared elevated:

source: Koyfin; 10-year chart of forward price to earnings multiple

These multiples make sense if revenue is increasing. Even the incredible rally in the stock during the 2020-2021 period (SAM is down 75% from its peak) made some sense in the context of expectations for the hard seltzer market at the time3. Some analysts were projecting that hard seltzer would be larger than the entire craft beer market within five years.

The hard seltzer craze has ended, however, and the problem with paying up for SAM now is that the business is not growing. Both depletions (essentially, the amount of beer actually consumed, rather than the amount shipped) and shipments are guided down 5-7% for full-year 2022. The midpoint of that range is a point worse than the company’s initial outlook for 2023. That follows another negative year in 2022, when depletions dropped 5% and shipments 3.8%.

Taking the longer view, revenue has grown nicely on a multi-year basis: 2023 revenue should be more than 60% above the 2019 level. But it appears the bulk of that growth has come from hard seltzer, a category that seems unlikely to contribute much growth going forward. Meanwhile, consolidated gross profit has fallen, and advertising and promotion expense has grown at a faster rate than sales. As a result, guidance for this year’s adjusted EPS (still a range of $7.00-$9.00 post-Q3) is below the 2019 GAAP print of $9.16.

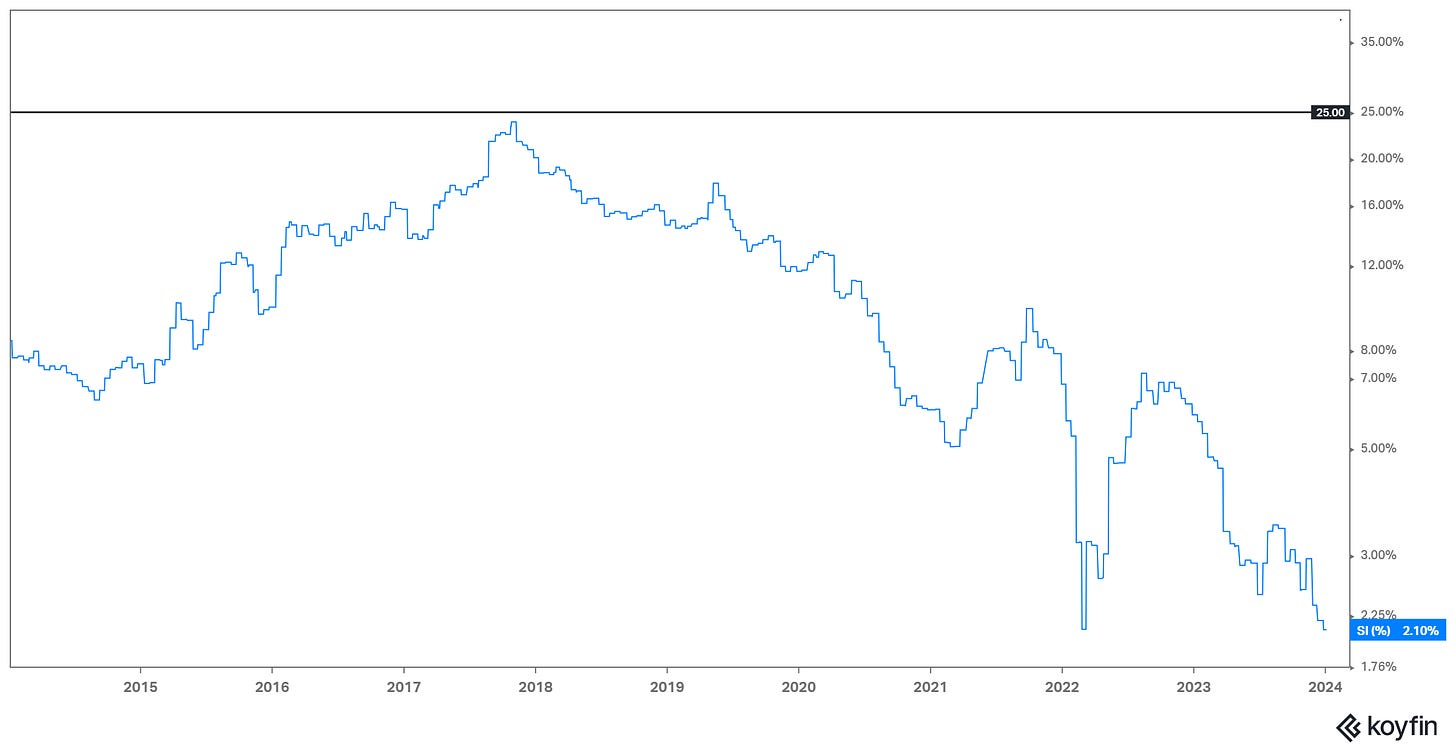

In that context, this is surprising:

source: Koyfin; short interest as a percentage of shares outstanding

There seems to be a solid short case here. The gross profit weakness is coming in part because Boston Beer can’t take pricing; the increase in advertising spend as a percentage of revenue adds another data point suggesting some inherent weakness in the company’s brands. Revenue is stagnant, the company has whiffed on multiple earnings reports (shares dropped 12% after the Q3 release in late October), and at least some of the company’s core customers are feeling the pinch of inflation.

Overall, the market is showing a lot of patience. It’s possible that hard seltzer jumpstarts, or that Boston Beer gets back to reasonably consistent growth. But patience eventually runs out, and short sellers are always looking for an attractive target. Boston Beer needs to show a reason in 2024 for longs to enter, and shorts to keep staying away.

As of this writing, Vince Martin has no positions in any securities mentioned.

Disclaimer: The information in this newsletter is not and should not be construed as investment advice. Overlooked Alpha is for information, entertainment purposes only. Contributors are not registered financial advisors and do not purport to tell or recommend which securities customers should buy or sell for themselves. We strive to provide accurate analysis but mistakes and errors do occur. No warranty is made to the accuracy, completeness or correctness of the information provided. The information in the publication may become outdated and there is no obligation to update any such information. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Contributors may hold or acquire securities covered in this publication, and may purchase or sell such securities at any time, including security positions that are inconsistent or contrary to positions mentioned in this publication, all without prior notice to any of the subscribers to this publication. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

We don’t appear alone in that opinion. In less than a month since the Investor Day, OMI is down 12% while the Russell 2000 Total Return is up 8%.

The logic here is that sleep apnea is most often caused by obesity; if Ozempic sharply reduces obesity rates, sleep apnea rates presumably would follow.

It wasn’t just investors who were optimistic: essentially every beverage company mooted the idea of entering the space before category growth ground to a halt in 2021.

Thanks for so many good ideas in 2023; excited for more this year! Congratulations, well done, and thank you for adding so much value here.

Maybe PayPal